UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

☐ |

Preliminary Proxy Statement |

|

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

☒ |

Definitive Proxy Statement |

|

☐ |

Definitive Additional Materials |

|

☐ |

Soliciting Material under §240.14a-12 |

|

Concrete Pumping Holdings, Inc. |

|

(Name of Registrant as Specified In Its Charter) |

|

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

|

☒ |

No fee required. |

||

|

☐ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

||

|

|

|

(1) |

Title of each class of securities to which transaction applies:

|

|

|

|

(2) |

Aggregate number of securities to which transaction applies:

|

|

|

|

(3) |

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

(4) |

Proposed maximum aggregate value of transaction:

|

|

|

|

(5) |

Total fee paid:

|

|

☐ |

Fee paid previously with preliminary materials. |

||

|

☐ |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

||

|

|

|

(1) |

Amount Previously Paid:

|

|

|

|

(2) |

Form, Schedule or Registration Statement No.:

|

|

|

|

(3) |

Filing Party:

|

|

|

|

(4) |

Date Filed:

|

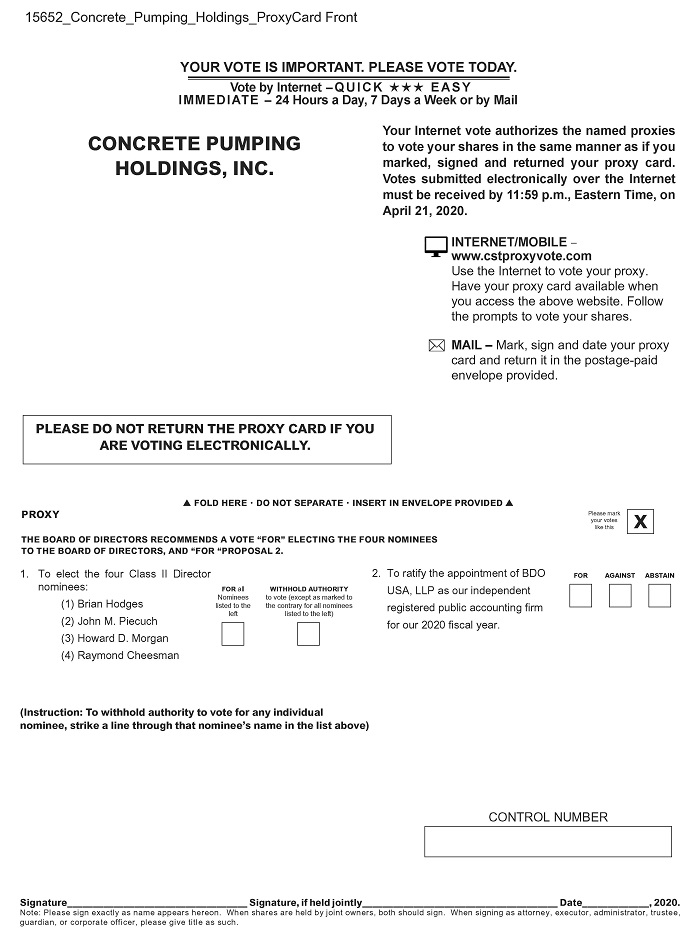

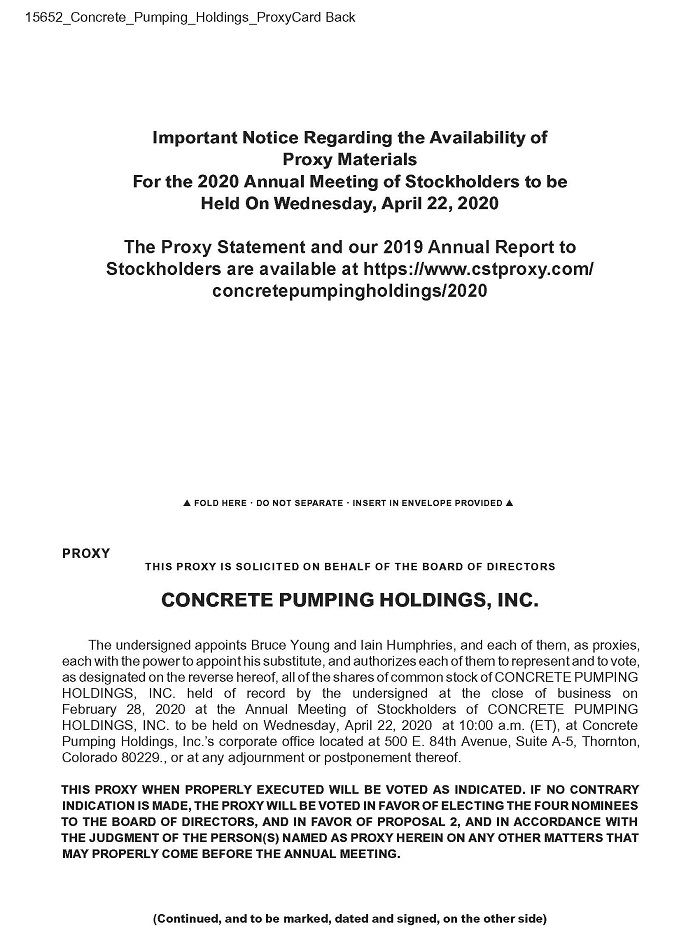

NOTICE OF 2020 ANNUAL MEETING OF STOCKHOLDERS

February 28, 2020

Dear Fellow Stockholders,

It is my pleasure to invite you to attend Concrete Pumping Holdings, Inc.’s 2020 Annual Meeting of Stockholders (the “Annual Meeting”) on Wednesday, April 22, 2020 at 10:00 a.m. (ET), at Concrete Pumping Holdings, Inc.’s corporate office located at 500 E. 84th Avenue, Suite A-5, Thornton, Colorado 80229. At the Annual Meeting, our stockholders will be asked:

|

|

1. |

To elect the four Class II Director nominees; |

|

|

2. |

To ratify the appointment of BDO USA, LLP as our independent registered public accounting firm for our 2020 fiscal year; and |

|

|

3. |

To transact such other business as may properly come before the meeting and any adjournment or postponement thereof. |

We know of no other matters to come before the Annual Meeting. Only stockholders of record at the close of business on February 28, 2020 are entitled to notice of and to vote at the Annual Meeting or any adjournment or postponement thereof. Whether or not you plan to attend the Annual Meeting, we encourage you to read the accompanying Proxy Statement and to submit your proxy card or voting instructions as soon as possible. For specific instructions on how to vote your shares, please refer to the instructions on the accompanying proxy card. Please read the enclosed information carefully before submitting your proxy.

Your vote is important. Please note that if you hold your shares through a broker, your broker cannot vote your shares on the election of directors in the absence of your specific instructions as to how to vote. In order for your vote to be counted, please make sure that you submit your vote to your broker.

We appreciate the confidence you have placed in us through your investment in us, and we look forward to seeing you at the Annual Meeting.

|

|

|

|

|

|

|

By Order of the Board of Directors, |

|

|

|

|

|

|

|

David A.B. Brown Chairman of the Board of Directors |

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS

FOR THE 2020 ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON APRIL 22, 2020

This Proxy Statement and our Annual Report for the fiscal

year ended October 31, 2019 are available on our website at www.concretepumpingholdings.com under “Investors”

TABLE OF CONTENTS

|

|

Page |

|

1 |

|

|

1 |

|

|

1 |

|

|

2 |

|

|

3 |

|

|

3 |

|

|

3 |

|

|

4 |

|

|

4 |

|

|

4 |

|

|

5 |

|

|

5 |

|

|

6 |

|

|

6 |

|

|

6 |

|

|

Process for Recommending or Nominating Potential Director Candidates |

7 |

|

8 |

|

|

8 |

|

|

9 |

|

|

9 |

|

|

9 |

|

|

11 |

|

|

12 |

|

|

16 |

|

|

17 |

|

|

17 |

|

|

18 |

|

|

18 |

|

|

19 |

|

|

19 |

|

|

20 |

|

|

22 |

|

|

22 |

|

|

23 |

|

|

23 |

|

| Equity Compensation Plan Information | 25 |

|

25 |

|

| Preferred Stock | 26 |

| Delinquent Section 16(a) Reports | 26 |

|

27 |

|

|

30 |

|

|

Stockholder Proposals for the 2021 Annual Meeting of Stockholders |

30 |

|

30 |

|

|

30 |

|

|

30 |

500 E. 84th Avenue, Suite A-5

Thornton, Colorado 80229

(303) 289-7497

PROXY STATEMENT

GENERAL INFORMATION ABOUT THE ANNUAL MEETING AND VOTING

Information About Attending the Annual Meeting

The 2020 Annual Meeting of Stockholders (the “Annual Meeting”) of Concrete Pumping Holdings, Inc. (the “Company,” “we,” “us” or “our”) will be held on Wednesday, April 22, 2020, at 10:00 a.m. (ET), at the Company’s corporate office located at 500 E. 84th Avenue, Suite A-5, Thornton, Colorado 80229. The doors to the meeting room will open for admission at 9:30 a.m. (ET). Directions to the meeting location are posted on our website located at www.concretepumpingholdings.com. This Proxy Statement will first be sent to stockholders on or about March 13, 2020.

Proof of stock ownership and some form of government-issued photo identification (such as a valid driver’s license or passport) will be required for admission to the Annual Meeting. Only stockholders who own shares of Concrete Pumping Holdings, Inc.’s common stock as of the close of business on February 28, 2020 (the “Record Date”) will be entitled to attend and vote at the Annual Meeting. If you are a stockholder of record as of the Record Date and you plan to attend the Annual Meeting, please save your proxy card and bring it to the Annual Meeting as your admission ticket. If you plan to attend the meeting but your shares are not registered in your name, you must bring evidence of stock ownership as of the Record Date, which you may obtain from your bank, stockbroker or other adviser, to be admitted to the meeting. No cameras, recording devices or large packages will be permitted in the meeting room.

Under appropriate circumstances, we may provide assistance or a reasonable accommodation to attendees of the Annual Meeting who require assistance to gain access to the meeting or to receive communications made at the meeting. If you would like to request such assistance or accommodation, please contact us at (303) 289-7497 or at Concrete Pumping Holdings, Inc., 500 E. 84th Avenue, Suite A-5, Thornton, Colorado 80229. Please note that we may not be able to accommodate all requests.

Information About this Proxy Statement

Why You Received this Proxy Statement. You have received these proxy materials because our board of directors (the “Board of Directors”) is soliciting your proxy to vote your shares at the Annual Meeting. This Proxy Statement includes information that we are required to provide to you under the rules of the Securities and Exchange Commission (the “SEC”) and that is designed to assist you in voting your shares.

Electronic Access to Proxy Statement and Annual Report. This Proxy Statement and our Annual Report for the fiscal year ended October 31, 2019 (the “Annual Report”) are available on the Company’s website at www.concretepumpingholdings.com under “Investors.” Instead of receiving paper copies of the Annual Report and Proxy Statement in the mail, stockholders can elect to receive an e-mail that will provide an electronic link to these documents. Choosing to receive your proxy materials online will save us the cost of producing and mailing documents to your home or business, and also will give you an electronic link to the proxy voting site.

Beneficial Owners. If you hold your shares in a brokerage account, you may also have the ability to receive copies of the Proxy Statement and Annual Report electronically. Please check the information provided in the proxy materials that your bank, broker or other holder of record sent to you regarding the availability of electronic delivery.

1

Information About Voting

Stockholders can vote in person at the Annual Meeting or by proxy. There are two ways to vote by proxy:

• By Internet—You can vote over the Internet by accessing the Internet website specified in the accompanying proxy card or voting instruction form and following the instructions provided to you; or

• By Mail—You can vote by mail by signing, dating and mailing the accompanying proxy card to the address provided therein.

Internet voting facilities for stockholders of record will be available 24 hours a day and will close at 11:59 p.m. (ET) on April 21, 2020. We encourage you to submit your proxy as soon as possible (by Internet or by mail) even if you plan to attend the meeting in person.

If your shares are held in the name of a bank, broker or other holder of record, you will receive instructions from the holder of record as to how to vote your shares. You must follow the instructions of the holder of record in order for your shares to be voted. Internet voting may also be offered to stockholders owning shares through certain banks and brokers. If your shares are not registered in your own name and you plan to vote your shares in person at the Annual Meeting, you should contact your broker or agent to obtain a legal proxy or broker’s proxy card and bring it to the Annual Meeting in order to vote.

Please note that if you hold your shares through a broker, your broker cannot vote your shares on the election of directors unless you have given your broker specific instructions as to how to vote. In order for your vote to be counted, please make sure that you submit your vote to your broker.

If you vote by proxy, the individuals named on the proxy card (your “proxies”) will vote your shares in the manner you indicate. You may specify whether your shares should be voted for or against all, any or none of the nominees for director and whether your shares should be voted for or against each of the other proposals. If you sign and return the proxy card without indicating your instructions, your shares will be voted as follows:

• FOR the election of all four Class II Directors nominees;

• FOR the ratification of the appointment of BDO USA, LLP as our independent registered public accounting firm for our 2020 fiscal year; and

• For or against any other matter properly presented before the meeting, in the discretion of the proxies.

You may revoke or change your proxy before the meeting for any reason by (1) if you are a registered stockholder (or if you hold your shares in “street name” and have a proper legal proxy from your broker), voting in person at the Annual Meeting, (2) submitting a later-dated proxy online (your last vote before the meeting begins will be counted), or (3) sending a written revocation that is received before the Annual Meeting to the Corporate Secretary of the Company, c/o Concrete Pumping Holdings, Inc. 500 E. 84th Avenue, Suite A-5, Thornton, Colorado 80229.

Each share of our common stock and preferred stock is entitled to one vote (except that holders of preferred stock may not vote on the election of directors). As of the Record Date, there were 58,250,165 shares of our common stock and 2,450,980 shares of our preferred stock outstanding.

2

Quorum Requirement

A quorum is necessary to hold a valid meeting. The holders of a majority in voting power of the outstanding capital stock entitled to vote at the Annual Meeting, present in person or represented by proxy, shall constitute a quorum. Abstentions and broker “non-votes” are counted as present for purposes of determining whether a quorum exists. A broker “non-vote” occurs when a bank or broker holding shares for a beneficial owner does not vote on a proposal because the broker does not have discretionary voting power for that particular item and has not received instructions from the beneficial owner. Banks and brokers will have discretionary voting power for the ratification of the appointment of BDO USA, LLP as our independent registered public accounting firm for our 2020 fiscal year (Proposal 2), but not for voting on the election of the Class II Director nominees (Proposal 1).

Required Votes for Action to be Taken

Four Class II Directors have been nominated for election to our Board of Directors at the Annual Meeting. Our Amended and Restated Bylaws (the “Bylaws”) provide that directors shall be elected by a plurality of the votes of the shares present and entitled to vote on the election of such directors. This means that the four Class II director nominees receiving the highest number of “FOR” votes cast will be elected. Abstentions and broker non-votes will have no effect on the outcome of the election.

For the ratification of the appointment of BDO USA, LLP as our independent registered public accounting firm, the approval requires the affirmative vote of a majority of the shares present or represented by proxy at the Annual Meeting and entitled to vote on such matter. Abstentions will have the effect of voting against this proposal. The following table summarizes the votes required for passage of each proposal and the effect of abstentions and uninstructed shares held by brokers.

Brokers and custodians cannot vote uninstructed shares on your behalf in director elections. For your vote to be counted, you must submit your voting instruction form to your broker or custodian.

|

Proposal |

|

Votes required for approval |

|

Abstentions |

|

Broker Uninstructed shares (Broker non-votes) |

|

|

1. |

Election of the four Class II Director nominees |

|

A plurality of the votes cast (the four nominees receiving the highest number of “FOR” votes cast will be elected) |

|

No impact |

|

No impact |

|

2. |

Ratification of the appointment of BDO USA, LLP as our independent registered public accounting firm for our 2020 fiscal year |

|

Majority of shares present in person or represented by proxy and entitled to vote |

|

Same as a vote “Against” |

|

Voted in the broker’s discretion |

Other Business to be Considered

Our Board of Directors does not intend to present any business at the Annual Meeting other than the proposals described in this Proxy Statement and knows of no other matters that are likely to be brought before the Annual Meeting. However, if any other matter properly comes before the Annual Meeting, your proxies will act on such matter in their discretion.

3

Information About the Company

Industrea Acquisition Corp. (“Industrea”) was incorporated as a blank check company on April 7, 2017 as a Delaware corporation, formed for the purpose of effecting a merger, capital stock exchange, asset acquisition, stock purchase, reorganization or similar business combination with one or more businesses. We were incorporated on August 29, 2018 as a Delaware corporation solely for the purpose of effectuating the business combination (the “Business Combination”) with a private operating company formerly called Concrete Pumping Holdings, Inc. (“CPH”) and Industrea, which was consummated on December 6, 2018 (the “Closing”). Upon the Closing, we acquired CPH and Industrea, and Industrea’s outstanding warrants were assumed by us and became exercisable for shares of our common stock on the same terms as were contained in such warrants prior to the Business Combination. In connection with the Closing, we changed our name from “Concrete Pumping Holdings Acquisition Corp.” to “Concrete Pumping Holdings, Inc.”

CORPORATE GOVERNANCE

Board of Directors

Our Board of Directors consists of twelve directors and is divided into three classes, with only one class of directors being elected in each year and each class serving a three-year term. Effective upon the Closing, each of Heather L. Faust, David G. Hall and Iain Humphries were elected by Industrea’s stockholders to serve as Class I directors; each of Brian Hodges, John M. Piecuch and Howard D. Morgan were elected by Industrea’s stockholders to serve as Class II directors; and each of David A.B. Brown, Tariq Osman and Bruce Young were elected by Industrea’s stockholders to serve as Class III directors. Pursuant to the terms of the rollover agreement, dated as of September 7, 2018 (the “Non-Management Rollover Agreement”), BBCP Investors, LLC (“Peninsula”) designated each of M. Brent Stevens, Matthew Homme and Raymond Cheesman to serve on our Board of Directors. Pursuant to that certain stockholders agreement, dated as of December 6, 2018 and amended on April 1, 2019 (the “Stockholders Agreement”), by and between the Company, CFLL Holdings, LLC (formerly known as CFLL Sponsor Holdings, LLC and Industrea Alexandria LLC) (“CFLL Sponsor” or the “Sponsor”), and the other parties thereto, Peninsula has nomination rights with respect to: (i) one director for as long as Peninsula beneficially owns more than 5% and up to 15% of the issued and outstanding shares of common stock as of December 6, 2018; (ii) two individuals for as long as Peninsula beneficially owns more than 15% and up to 25% of the issued and outstanding shares of common stock as of December 6, 2018; and (iii) three directors for as long as Peninsula owns more than 25% of the issued and outstanding shares of common stock as of December 6, 2018. If Peninsula’s beneficial ownership falls below one of these thresholds, Peninsula’s nomination right in respect of such threshold will permanently expire. On December 9, 2018, in connection with Peninsula’s designation of each of Raymond Cheesman, Matthew Homme and M. Brent Stevens to serve on our Board of Directors pursuant to the Non-Management Rollover Agreement, the size of our Board of Directors was increased from nine to twelve members, and our Board of Directors appointed Mr. Homme to serve as a Class I director, Mr. Cheesman to serve as a Class II director and Mr. Stevens to serve as a Class III director.

As such, our directors are currently divided among the three classes as follows:

• The Class I directors are Heather L. Faust, David G. Hall, Iain Humphries and Matthew Homme, with terms expiring at our annual meeting of stockholders to be held in 2022;

• The Class II directors are Brian Hodges, John M. Piecuch, Howard D. Morgan and Raymond Cheesman, with terms expiring at the Annual Meeting; and

• The Class III directors are David A.B. Brown, Tariq Osman, Bruce Young and M. Brent Stevens, with terms expiring at our annual meeting of stockholders to be held in 2021.

4

Director Independence

Nasdaq listing standards require that a majority of our Board of Directors be independent. An “independent director” is defined generally as a person other than an officer or employee of the company or its subsidiaries or any other individual having a relationship which in the opinion of our Board of Directors, would interfere with the director’s exercise of independent judgment in carrying out the responsibilities of a director. Our Board of Directors conducts an annual assessment of the independence of each member of our Board of Directors, taking into consideration all relationships between us and/or our officers, on the one hand, and each director on the other, including the director’s commercial, economic, charitable and family relationships, and such other criteria as our Board of Directors may determine from time to time. Our Board of Directors has determined that Ms. Faust and Messrs. Hall, Hodges, Piecuch, Morgan, Brown, Osman, Cheesman and Homme, being a majority of the directors on the Board, are “independent directors” as defined in the Nasdaq listing standards and applicable SEC rules.

Board Leadership Structure

Our Board of Directors does not have a policy regarding separation of the roles of Chief Executive Officer and Chairman of the Board of Directors. The Board of Directors believes it is in our best interests to make that determination based on circumstances from time to time. Currently, neither our Chairman nor our Vice Chairman of the Board is an officer of the Company. The Chairman of the Board of Directors chairs the meetings of our Board of Directors and meetings of our stockholders, with input from the Vice Chairman and the Chief Executive Officer. The Vice Chairman works with the Chief Executive Officer to develop and gain approval from the Board of Directors of the growth strategy of Concrete Pumping and works with the Chief Executive Officer and Chief Financial Officer in coordinating our activities with key external stakeholders and parties. These activities include corporate governance matters, investor relations, financing and mergers and acquisitions. Our Board of Directors believes that this structure, combined with our corporate governance policies and processes, creates an appropriate balance between strong and consistent leadership and independent oversight of our business.

Our Board of Directors believes that our current leadership structure and the composition of our Board of Directors protect stockholder interests and provide adequate independent oversight, while also providing outstanding leadership and direction for our Board of Directors and management.

The independent directors of the Board of Directors, and each committee of the Board of Directors (of which all are comprised of independent directors), meet in executive sessions, without management present, during each regularly scheduled Board or committee meeting and are active in the oversight of the Company. Each independent director has the ability to add items to the agenda for Board meetings or raise subjects for discussion that are not on the agenda for that meeting. In addition, our Board of Directors and each committee of the Board of Directors has open access to members of management and the authority to retain independent legal, financial and other advisors as they deem appropriate.

5

Policies and Procedures for Related Person Transactions

Our Code of Ethics requires us to avoid, wherever possible, all conflicts of interests, except under guidelines or resolutions approved by our Board (or the appropriate committee of our Board) or as disclosed in our public filings with the SEC. Under the Code of Ethics, conflict of interest situations include any financial transaction, arrangement or relationship (including any indebtedness or guarantee of indebtedness) involving the Company.

In addition, our Audit Committee, pursuant to its charter, is responsible for reviewing and approving related party transactions to the extent that we enter into such transactions. An affirmative vote of a majority of the members of our Audit Committee present at a meeting at which a quorum is present is required to approve a related party transaction. A majority of the members of our entire Audit Committee constitutes a quorum. Without a meeting, the unanimous written consent of all of the members of our Audit Committee is required to approve a related party transaction. We also require each of our directors and executive officers to complete a directors’ and officers’ questionnaire that elicits information about related party transactions.

These procedures are intended to determine whether any such related party transaction impairs the independence of a director or presents a conflict of interest on the part of a director, employee or officer.

Our Audit Committee reviews on a quarterly basis all payments that were made to our officers or directors or our or their affiliates.

Role of the Board of Directors in Risk Oversight

Members of the Board of Directors have an active role as a whole and also at the Board committee level, in overseeing management of the Company’s risk. While the Board of Directors is ultimately responsible for overall risk oversight at our Company, our four Board committees assist the full Board of Directors in fulfilling its oversight responsibilities in certain areas of risk. The Audit Committee has primary responsibility for reviewing and discussing the Company’s policies with respect to risk assessment and risk management, including guidelines and policies to govern the process by which the Company’s exposure to risk is handled, and for monitoring the Company’s major financial risk exposures and the steps the Company has taken to monitor and control such exposures, including the maintenance and monitoring of a whistleblower hotline. In connection with its risk assessment and management responsibilities, the Audit Committee oversees risks related to cybersecurity and other risks relevant to our computerized information system controls and security. The Audit Committee also is charged with overseeing risks with respect to our related party transaction policy as noted above, and with any potential conflicts of interest with directors and director nominees. The Compensation Committee is charged with ensuring that our compensation policies and procedures do not encourage risk taking in a manner that would have a material adverse impact on the Company. The Corporate Governance and Nominating Committee is charged with overseeing the process of conducting management succession planning and management development. Each Committee reports its findings to the full Board of Directors for consideration.

Communications with the Board of Directors

If our stockholders or other interested parties wish to contact any member of our Board of Directors, they may write to the Board of Directors or to an individual director in care of the Corporate Secretary at Concrete Pumping Holdings, Inc., 500 E. 84th Avenue, Suite A-5, Thornton, Colorado 80229. Relevant communications will be distributed to the Board of Directors, or to any individual director or directors as appropriate, depending on the facts and circumstances outlined in the communication. Communications that are unrelated to the duties and responsibilities of the Board of Directors will not be forwarded, such as business solicitations or advertisements, junk mail, mass mailings and spam, new product or services suggestions, product or services complaints or inquiries, resumes and other forms of job inquiries, or surveys. In addition, material that is threatening, illegal or similarly unsuitable will be excluded. Any communication that is screened as described above will be made available to any director upon his or her request.

6

Process for Recommending or Nominating Potential Director Candidates

Subject to the rights provided under the Stockholders Agreement, the Corporate Governance and Nominating Committee is responsible for recommending nominees for Board membership to fill vacancies or newly created positions, and for recommending the persons to be nominated for election at the Annual Meeting. In connection with the selection and nomination process, the Corporate Governance and Nominating Committee reviews the desired experience, skills, diversity and other qualities to ensure appropriate Board composition, taking into account the current Board members and the specific needs of the Company and the Board of Directors. In connection with the process of nominating incumbent directors for re-election to the Board, the Corporate Governance and Nominating Committee also considers the director’s tenure on and unique contributions to the Board of Directors.

The Corporate Governance and Nominating Committee may retain, as appropriate, search firms to assist in identifying qualified director candidates. The Corporate Governance and Nominating Committee will generally look for individuals who have displayed high ethical standards, integrity, sound business judgment and a willingness to devote adequate time to Board duties.

The Corporate Governance and Nominating Committee continually reviews Board composition and potential additions while striving to maintain and grow a diverse and broad skill set that complements the business. The Corporate Governance and Nominating Committee may consider certain factors related specifically to our business when considering a potential candidate, including, but not limited to:

|

|

• |

Knowledge of the concrete pumping and waste management industries; |

|

|

• |

Accounting or related financial management expertise; |

|

|

• |

Experience executing growth and merger and acquisition strategies, to support the strategic plan for the Company; |

|

|

• |

International exposure and diversity of cultural background and experience with global markets, because the Company has international operations; and |

|

|

• |

Leadership experience at an executive level with understanding of the development and implementation of strategies. |

The Corporate Governance and Nominating Committee has not assigned specific weights to particular criteria and no particular criterion is necessarily applicable to all prospective nominees. In the evaluation of potential new candidates, the Corporate Governance and Nominating Committee considers each candidate’s qualifications in light of the then-current mix of Board attributes, including diversity. Continuing directors are evaluated by the Corporate Governance and Nominating Committee in the same way, including the continuing director’s past contributions to the Board of Directors in such evaluation.

Although the Board of Directors does not have a formal policy specifying how diversity of background and personal experience should be applied in identifying or evaluating director candidates, to help ensure that the Board of Directors remains aware of and responsive to the needs and interests of our customers, stockholders, employees and other stakeholders, the Board of Directors believes it is important to identify qualified director candidates that would increase the gender, racial, ethnic and/or cultural diversity of the Board of Directors. Accordingly, the Corporate Governance and Nominating Committee makes an effort when nominating new directors to ensure that the composition of the Board of Directors reflects a broad diversity of experience, profession, expertise, skill, and background, including gender, racial, ethnic, and/or cultural diversity. Nominees are not discriminated against on the basis of gender, race, religion, national origin, disability or sexual orientation. The Board of Directors and the Corporate Governance and Nominating Committee are committed to actively seeking female and minority candidates to join the Board of Directors.

7

Stockholders may recommend individuals to the Board of Directors for nomination and also have the right under our Bylaws to nominate directors. Stockholders may recommend individuals to the Board of Directors for consideration as potential director candidates by submitting candidates’ names, appropriate biographical information (including age, business address and residence address, principal occupation or employment and relevant experience), the class or series and number of shares of capital stock of the Company which are directly or indirectly owned beneficially or of record by the candidate, the date such shares were acquired and the investment intent of such acquisition, and any other information relating to the candidate that would be required to be disclosed in a proxy statement or other similar filing to the principal executive offices of the Company at:

Corporate Secretary

c/o Concrete Pumping Holdings, Inc.

500 E. 84th Avenue, Suite A-5

Thornton, Colorado 80229

Assuming the appropriate information has been provided, the Board of Directors will evaluate stockholder-recommended candidates by following substantially the same process, and applying substantially the same criteria, as it follows for candidates submitted by others. If the Board of Directors determines to nominate a stockholder-recommended candidate and recommends his or her election to the Board of Directors, then his or her name will be included in the proxy statement for the next annual meeting of stockholders.

In order for stockholders to nominate director candidates under our Bylaws, our Bylaws require that the Company be given advance written notice of stockholder nominations for election to the Board of Directors. Such nomination must contain the information required by our Bylaws with respect to the nominee and the stockholder. To be timely, a stockholder’s notice must be delivered to the Company’s Corporate Secretary, in the case of an annual meeting, not earlier than the close of business on the 120th day and no later than the close of business on the 90th day prior to the first anniversary of the date of the preceding year’s annual meeting.

Succession Planning and Management Development

The Board of Directors supports the development of the Company’s executive talent, especially the Chief Executive Officer and the senior leaders of the Company, because continuity of strong leadership at all levels of the Company is part of the Board’s mandate for delivering strong performance to stockholders. To further this goal, the executive talent development and succession planning process is overseen by the Corporate Governance and Nominating Committee pursuant to its charter. The Corporate Governance and Nominating Committee is charged with developing and recommending to the Board of Directors the approval of a succession plan for the Chief Executive Officer. The Corporate Governance and Nominating Committee also is responsible for implementing the succession plan by developing and evaluating potential candidates for executive positions, and periodically reviewing the succession plan.

The Compensation Committee also indirectly supports the succession planning process through its annual approval of compensation targets and achievement of goals for incentive compensation payments.

Code of Business Conduct and Ethics

We maintain a Code of Business Conduct and Ethics (the “Code of Ethics”) that applies to all of our directors, executive officers and employees. Our Code of Ethics is posted on our corporate website at www.concretepumpingholdings.com and can be accessed by clicking on the “Investors” link followed by the “Corporate Governance” link and finally the "Governance Documents" link. Any amendments to or waivers of our Code of Ethics relating to our directors or executive officers that is required to be disclosed also will be posted on our website. Information appearing on our website is not incorporated by reference into this Proxy Statement. We have designated our Chief Executive Officer and Chief Financial Officer as compliance officers who oversee our ethics and compliance program and provide regular reports to the Audit Committee and Corporate Governance and Nominating Committee on the program’s effectiveness and the status of any reports or complaints made under the Code of Ethics reporting procedures.

8

Availability of Committee Charters and SEC Filings

We believe that the charters adopted by the Audit, Compensation and Corporate Governance and Nominating Committees comply with applicable corporate governance rules of Nasdaq. These charters are available on our website at www.concretepumpingholdings.com and can be accessed by clicking on the “Investors” link followed by the “Corporate Governance” link. Information appearing on our website is not incorporated by reference into this Proxy Statement.

DIRECTOR COMPENSATION

During fiscal year 2019, each Director who was not an officer of the Company (“Non-Employee Director”) earned an annual retainer in the amount of $100,000. In addition, the Chairperson (David A.B. Brown), Vice Chairperson (Tariq Osman), Audit Committee Chairperson (John Piecuch), and Compensation Committee Chairperson (Brian Hodges) received an additional retainer of $50,000 for these services (for a total retainer of $150,000). This is the only compensation paid to our Directors and no other material arrangements are present.

The following table sets forth information regarding the compensation of the Company's Non-Employee Directors for the fiscal year ended October 31, 2019. The two Directors (Messrs. Young and Humphries) who are executive officers receive no compensation for serving as Directors in addition to their compensation received as executive officers.

| Name |

Fees Earned or Paid in Cash(1) |

Total | ||||||

| David A.B. Brown | $ | 135,000 | $ | 135,000 | ||||

| Raymond Cheesman | $ | 90,000 | $ | 90,000 | ||||

| David G. Hall | $ | 90,000 | $ | 90,000 | ||||

| Matthew Homme | $ | 90,000 | $ | 90,000 | ||||

| Brian Hodges | $ | 135,000 | $ | 135,000 | ||||

| Howard D. Morgan | $ | 90,000 | $ | 90,000 | ||||

| Tariq Osman | $ | 135,000 | $ | 135,000 | ||||

| John Piecuch | $ | 135,000 | $ | 135,000 | ||||

| Brent Stevens | $ | 90,000 | $ | 90,000 | ||||

| Heather L. Faust | $ | 90,000 | $ | 90,000 | ||||

|

|

(1) |

The Director Compensation is only for the Successor Period from December 6, 2018 through October 31, 2019 in conjunction with the Business Combination. The Company did not pay any of its Non-Employee Directors prior to the consummation of the Business Combination. |

MEETINGS AND COMMITTEES OF THE BOARD OF DIRECTORS

Our Board has established the following committees: an audit committee (the “Audit Committee”), a compensation committee (the “Compensation Committee”), a corporate governance and nominating committee (the “Corporate Governance and Nominating Committee”) and an indemnification committee (the “Indemnification Committee”). Each of the committees reports to the Board. Members serve on these committees until their resignation or until otherwise determined by our Board. The composition, duties and responsibilities of these committees are set forth below.

Our Board of Directors has affirmatively determined, upon recommendation of the Corporate Governance and Nominating Committee, that all of the members of our Audit, Compensation and Corporate Governance and Nominating Committees are independent as defined under the Nasdaq listing standards. The Board of Directors also has determined that all members of the Audit Committee meet the independence requirements contemplated by the Nasdaq listing standards and Rule 10A-3 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and, in determining the independence of all members of our Compensation Committee, the Board of Directors took into account the additional independence considerations required by the Nasdaq listing rules and Rule 10C-1 of the Exchange Act relating to Compensation Committee service.

The composition, duties and responsibilities of these committees are set forth below:

Audit Committee. The Audit Committee is responsible for, among other things, (i) appointing, retaining and evaluating the Company’s independent registered public accounting firm and approving all services to be performed by them; (ii) overseeing the Company’s independent registered public accounting firm’s qualifications, independence and performance; (ii) overseeing the financial reporting process and discussing with management and the Company’s independent registered public accounting firm the interim and annual financial statements that the Company files with the SEC; (iv) reviewing and monitoring the Company’s accounting principles, accounting policies, financial and accounting controls and compliance with legal and regulatory requirements; (v) establishing procedures for the confidential anonymous submission of concerns regarding questionable accounting, internal controls or auditing matters; and (vi) reviewing and approving related person transactions.

The current members of our Audit Committee are Messrs. Brown, Piecuch and Cheesman, with Mr. Piecuch serving as the chair of the Audit Committee. All members of the Audit Committee are independent within the meaning of the federal securities laws and the meaning of the Nasdaq Rules. Each member of the Audit Committee meets the requirements for financial literacy under the applicable rules and regulations of the SEC and Nasdaq, and the Board has determined that Mr. Brown is an “audit committee financial expert,” as that term is defined by the applicable rules of the SEC. The Board has approved a written charter under which the Audit Committee operates. A copy of the charter is available free of charge on the Company’s website at www.concretepumpingholdings.com. Information appearing on our website is not incorporated by reference into this Proxy Statement.

9

Compensation Committee. The Compensation Committee is responsible for, among other things, (i) reviewing key employee compensation goals, policies, plans and programs; (ii) reviewing and approving the compensation of the Company’s directors, chief executive officer and other executive officers; (iii) reviewing and approving employment agreements and other similar arrangements between the Company and the Company’s executive officers; and (iv) administering the Company’s stock plans and other incentive compensation plans.

The current members of the Compensation Committee are Messrs. Osman, Hodges, Morgan and Cheesman, with Mr. Hodges serving as chair of the Compensation Committee. All of the members of the Compensation Committee are independent within the meaning of the federal securities laws and the meaning of the Nasdaq Rules with respect to compensation committee membership. The Board has approved a written charter under which the Compensation Committee operates. A copy of the charter is available free of charge on the Company’s website at www.concretepumpingholdings.com. Information appearing on our website is not incorporated by reference into this Proxy Statement.

Corporate Governance and Nominating Committee. The Corporate Governance and Nominating Committee is responsible for, among other things, considering and making recommendations to the Board on matters relating to the selection and qualification of directors of the Company and candidates nominated to serve as directors of the Company, as well as other matters relating to the duties of directors of the Company, the operation of the Board and corporate governance.

The current members of the Corporate Governance and Nominating Committee are Messrs. Brown, Hall, Osman and Homme, with Mr. Brown serving as the chair of the Corporate Governance and Nominating Committee. All of the members of the Corporate Governance and Nominating Committee are independent within the meaning of the federal securities laws and the meaning of the Nasdaq Rules. The Board has approved a written charter under which the Corporate Governance and Nominating Committee operates. A copy of the charter is available free of charge on the Company’s website at www.concretepumpingholdings.com. Information appearing on our website is not incorporated by reference into this Proxy Statement.

Indemnification Committee. The Indemnification Committee is responsible for evaluating post-Closing indemnification claims under the merger agreement entered into in connection with the Business Combination. The current members of the Indemnification Committee are Messrs. Brown, Osman and Piecuch.

Meetings of the Board of Directors

In fiscal year 2019, our Board of Directors met four times and the Audit Committee also met four times. The Compensation Committee met seven times. The Corporate Governance and Nominating Committee met one time and the Indemnification Committee met zero times. In addition, during the last fiscal year all directors attended at least 75% of the total number of meetings of the Board of Directors (held during the period for which he or she has been a director) and the total number of meetings held by all committees of the Board of Directors on which he or she served (during the periods that he or she served). While we do not have a formal policy requiring our directors to attend stockholder meetings, our directors are invited and encouraged to attend all meetings of stockholders. All, excluding one, of our directors at the time attended the 2019 Annual Meeting of Stockholders.

10

PROPOSAL ONE: ELECTION OF DIRECTORS

Class II Directors Standing for Re-Election

At the Annual Meeting, stockholders will be asked to vote for the four Class II nominees listed below to serve until the 2023 annual meeting of stockholders and the election and qualification of his or her successor, or until such director’s earlier death, disqualification, resignation or removal. Proxies cannot be voted for a greater number of persons than the nominees named below. Each of the nominees listed below is currently a member of our Board of Directors and has agreed to stand for re-election. There are no family relationships among our directors, or between our directors and executive officers. Ages are as of the date of the Annual Meeting.

|

Brian Hodges |

|

Director since 2018 |

Brian Hodges, age 66, has been a member of our Board of Directors since the consummation of the Business Combination. Mr. Hodges served as a director of Industrea from July 2017 until the consummation of the Business Combination. From August 1997 to December 2015, Mr. Hodges was the Managing Director and Chief Executive Officer of Bradken (ASX: BKN), an Australian public company and global manufacturer and supplier of steel products for the mining, transport, general industrial and contract manufacturing markets. During his tenure as chief executive of Bradken, Mr. Hodges guided Bradken through periods of considerable change and corporate activity with four different owners. Over the course of his career, he has gained considerable management and leadership experience in raw material production and processing, supply and logistics and steel manufacturing. Mr. Hodges holds a Bachelor of Chemical Engineering from the University of Newcastle.

We believe Mr. Hodges is qualified to serve on our Board of Directors based on his leadership and business experience; his track record as the managing director and chief executive officer of Bradken; and his network of contacts in the industrial manufacturing and services industry.

|

Howard D. Morgan |

|

Director since 2018 |

Howard D. Morgan, age 57, has been a member of our Board of Directors since August 29, 2018. Mr. Morgan was Industrea’s Chief Executive Officer and a director of Industrea from April 2017 until the consummation of the Business Combination. Mr. Morgan has been a co-founder, Partner and Senior Managing Director of Argand as well as a member of its Management Committee and Investment Committee since September 2015. Prior to forming Argand, Mr. Morgan was the President of Castle Harlan from September 2014 to July 2015 and Co-President from August 2010 to September 2014. In addition, he served as chief executive officer and president of CHI Private Equity from February 2015 to July 2015. Until July 2015, Mr. Morgan was also a member of the board of directors and associated board committees of CHAMP. Mr. Morgan joined Castle Harlan in 1996. Previously, Mr. Morgan was a partner at The Ropart Group, a private equity investment firm, and began his career at Allen & Company, Inc. Mr. Morgan is currently on the advisory board of Oase Management GmbH since July 2018. Mr. Morgan is a former director of over one dozen companies, including Shelf Drilling Inc., Pretium Packaging, LLC, IDQ, Securus Technologies, Inc., Baker & Taylor Acquisitions Corp., Polypipe, Austar United Communications Ltd. (ASX: AUN), Norcast Wear Solutions, Inc., AmeriCast Technologies, Inc., Ion Track Instruments, Inc., Land ‘N’ Sea Distributing, Inc., Penrice Soda Products Pty. Ltd., Branford Chain, Inc. and various CHAMP entities. He is a director and past Chairman of the Harvard Business School Club of New York, Chairman of the Parkinson’s Foundation, a director of the Alexander Hamilton Institute and the World Press Institute, and a director and Treasurer of the Friends of the Garvan Institute of Medical Research. Mr. Morgan was a director and officer of the Harvard Business School Alumni Board from 2006 to 2011. He received his B.A. from Hamilton College in Mathematics and Government and his M.B.A. from the Harvard Business School.

We believe that Mr. Morgan is qualified to serve on our Board of Directors based on his extensive leadership and board experience; his track record as a partner and senior managing director of Argand and as president of Castle Harlan; and his network of contacts in the industrial manufacturing and services industries.

11

|

John M. Piecuch |

|

Director since 2018 |

John M. Piecuch, age 71, has been a member of our Board of Directors since the consummation of the Business Combination. Mr. Piecuch is a retired ex-Chief Executive Officer of several successful concrete construction companies, most recently serving as President and Chief Executive Officer of MMI Products, Inc., which, at the time, was the largest manufacturer of welded steel reinforcing products for concrete construction, from 2001 to 2006. From 1996 to 2001, Mr. Piecuch served as President and Chief Executive Officer of Lafarge Corporation, one of the largest construction materials companies in North America. He also served in various other positions with Lafarge Corporation and its parent entity, Lafarge S.A., from 1987 to 1996. From 1979 to 1986, Mr. Piecuch held various positions, including President of the Cement Division of National Gypsum Company. Mr. Piecuch currently serves as advisor and a director of JMP Construction Materials, LLC and currently serves as lead director of Brampton Brick Limited. Previously, Mr. Piecuch served as a director of Brundage-Bone from 2011 to 2014, including as Chairman of its compensation committee and a member of its audit committee. He also served as non-Executive Chairman of U.S. Concrete, Inc. from 2009 to 2010. Mr. Piecuch holds an M.B.A. and B.S.B.A., both in Finance, from the University of Akron.

We believe that Mr. Piecuch is qualified to serve on our Board of Directors based on his extensive experience advising similar companies and extensive directorship experience.

|

Raymond Cheesman |

|

Director since 2018 |

Raymond Cheesman, age 60, has been a member of our Board of Directors since December 9, 2018. Mr. Cheesman is a Senior Research Analyst at Anfield Capital, a registered investment advisor that serves as the advisor to the Anfield Universal Fixed Income Fund, an absolute return bond strategy seeking to deliver positive returns over full market cycles (“Anfield”). Prior to joining Anfield, Mr. Cheesman spent 17 years at Jefferies & Company where he worked as both an investment banker and high yield analyst. Mr. Cheesman received his B.B.A. in Finance from George Washington University.

We believe Mr. Cheesman is qualified to serve on our Board of Directors based on his business experience and strong background in finance.

Our Board of Directors recommends that you vote FOR

the election of each of the Class II director nominees.

|

Directors Continuing in Office |

In addition to the four directors nominated for election at the Annual Meeting, the following eight persons currently serve on our Board of Directors:

Class I Directors to serve until the 2022 Annual Meeting of Stockholders:

|

Heather L. Faust |

|

Director since 2018 |

Heather L. Faust, age 40, has been a member of our Board of Directors since the consummation of the Business Combination. Ms. Faust was Industrea’s Executive Vice President and a member of the Industrea board from April 2017 until the consummation of the Business Combination. Ms. Faust has been a co-founder, Partner and Managing Director of Argand as well as a member of its Management Committee and Investment Committee since September 2015. Previously, she was a Managing Director at Castle Harlan, where she worked from August 2008 to July 2015. In addition, she served as a Managing Partner of CHI Private Equity from February 2015 to July 2015. Prior to joining Castle Harlan, Ms. Faust was a management consultant at McKinsey & Company, where she worked in the United States and abroad across a variety of industries. Ms. Faust advised and directly assisted her clients in defining and implementing key strategic and operational business transformations. Ms. Faust’s experience also includes roles in the consumer industry as well as international development work in the Middle East. She has been a director of Sigma Electric since October 2016, chair of the advisory board for Oase Management GmbH since July 2018, and a director of Tensar Corporation, an industrial manufacturing company, since July 2014. Ms. Faust also previously served as a director of Baker & Taylor Acquisitions Corp., IDQ and Ames True Temper. Ms. Faust graduated Cum Laude from Princeton University with a BSE in Operations Research and Financial Engineering and holds an MBA from the Harvard Business School.

We believe Ms. Faust is qualified to serve on our Board of Directors based on her leadership and business experience; her track record as a partner and managing director of Argand; and her network of contacts in the industrial manufacturing and services industry.

12

|

David G. Hall |

|

Director since 2018 |

David G Hall, age 61, has been a member of our Board of Directors since the consummation of the Business Combination. Mr. Hall served as a director of Industrea from July 2017 until the consummation of the Business Combination. Mr. Hall was the Chief Executive Officer of Polypipe (LON: PLP) and a member of Polypipe’s board of directors from September 2005 to his retirement in October 2017. Polypipe is one of Europe’s largest and most innovative manufacturers of plastic piping and energy efficient ventilation systems for the residential, commercial, civil and Infrastructure sectors. Following a number of divisional Managing Director positions in both private and publicly listed companies, Mr. Hall led the management buyout of Polypipe in Sept 2005, and following a number of disposals and acquisitions to reposition and refocus the business after a successful period of private ownership, Polypipe listed on the main market of the London Stock Exchange during April 2014. The company achieved FTSE 250 status in January 2016. Mr. Hall has been a non-executive director of Brintons Carpets Limited since February 2018. Mr. Hall served as President of the British Plastics Federation and vice Chairman of the Construction Products Association, and has more than 20 years of experience in the building products industry. Mr. Hall holds a Bachelor of Science in Mechanical Engineering from Kingston University.

We believe Mr. Hall is qualified to serve on our Board of Directors based on his leadership and business experience; his track record as the chief executive officer of Polypipe; and his network of contacts in the industrial manufacturing and services industry.

|

Iain Humphries |

|

Director since 2018 |

Iain Humphries, age 45, has served as our Chief Financial Officer and Secretary and a member of our Board of Directors since the consummation of the Business Combination. Mr. Humphries has served as the Chief Financial Officer of Brundage-Bone since November 2016. Prior to joining Brundage-Bone, Mr. Humphries was the Chief Financial Officer of Wood Group PSN Americas from August 2013 to August 2016, having joined Wood Group PLC in 2005. Mr. Humphries has spent twelve years working in various finance leadership roles based in the United States and has over 20 years of international financial and management experience in the oil & gas, power generation and public accounting sectors. He is a Chartered Accountant of the Institute of Chartered Accountants of Scotland (ICAS) and holds a 1st Class Honors Degree in Accounting & Finance from The Robert Gordon University located in Aberdeen, Scotland.

We believe that Mr. Humphries is qualified to serve on our Board of Directors based on his knowledge of the Company and his extensive international financial and managerial experience.

|

Matthew Homme |

|

Director since 2018 |

Matthew Homme, age 40, has been a member of our Board of Directors since December 9, 2018. Mr. Homme is a Managing Director at Peninsula Pacific, a private investment fund focused on control investments in the gaming, consumer and industrial sectors. Prior to joining Peninsula Pacific in 2013, Mr. Homme was a Principal with Aurora Resurgence where he focused on buyouts and special situations investments for middle-market companies and served on the boards of directors of multiple portfolio companies in North America and Europe. Previously, Mr. Homme worked in the Investment Banking Department of Jefferies & Company. Mr. Homme graduated summa cum laude from the Wharton School at the University of Pennsylvania with a B.S. in Economics and holds an M.B.A. from the Harvard Business School.

We believe Mr. Homme is qualified to serve on our Board of Directors based on his business experience and strong background in finance.

13

Class III Directors to serve until the 2021 Annual Meeting of Stockholders:

|

David A.B. Brown, Chairman of the Board of Directors |

|

Director since 2018 |

David A.B. Brown, age 76, has been our Chairman since the consummation of the Business Combination. Mr. Brown was Industrea’s Non-Executive Chairman from July 2017 until the consummation of the Business Combination. Mr. Brown was the Chairman of the board of directors of Layne Christensen Company (Nasdaq: LAYN), a global water management, construction and drilling company, from May 2005 until June 2018 and served as its President and Chief Executive Officer from June 2014 to January 2015. In addition, Mr. Brown has served on the board of directors of EMCOR Group, Inc. (NYSE: EME) since December 1994, of Hercules Offshore, Inc. (OTC: HERO), an energy services company, from February 2015 to December 2016 and of Williams Industrial Service Group Inc. (OTC: WLMS) since May 2016. Mr. Brown served as the Chairman of the board of directors of Pride International, Inc. (“Pride”) until Pride’s acquisition by Ensco (NYSE: ESV) in May 2011 for approximately $8.6 billion, and he served as a member of Ensco’s board of directors from May 2011 to May 2014. Mr. Brown also previously served as the co-founder and President of The Windsor Group, Inc., and a director of numerous other companies in the energy industry. Mr. Brown is a Chartered Public Accountant. He earned his Bachelor of Commerce and a Masters in Accounting from McGill University and an M.B.A. from Harvard Business School.

We believe that Mr. Brown is qualified to serve on our Board of Directors based on his extensive leadership and business experience; his strong background in finance and public company governance; and his network of contacts in the industrial manufacturing and services industry.

|

Tariq Osman, Vice Chairman of the Board of Directors |

|

Director since 2018 |

Tariq Osman, age 41, has been a member of our Board of Directors since August 29, 2018. Mr. Osman was Industrea’s Executive Vice President and a member of the Industrea Board from April 2017 until the consummation of the Business Combination. Mr. Osman has been a co-founder, Partner and Managing Director of Argand as well as a member of its Management Committee and Investment Committee since September 2015. Previously, he was a Managing Director at Castle Harlan (and its affiliate, CHAMP), where he worked from January 2003 to July 2015, where he focused on private equity transactions across a wide range of industries, including portfolio management work for Shelf Drilling, Gold Star Foods, Caribbean Restaurants, International Energy Services, Blue Star Group and Austar United Communications. In addition, he served as a Managing Partner of CHI Private Equity from February 2015 to July 2015. Mr. Osman also previously worked at McKinsey & Company as a management consultant. In this role, he advised clients in the oil and gas, mining, construction and telecommunications sectors on strategy and operational improvements. Mr. Osman began his career in Australia as an engineer at Gutteridge, Haskins & Davey, working on oil and gas, mining and government infrastructure projects. He has been Chairman of the board of directors of Sigma Electric since October 2016, Chairman of the board of directors of Brintons Carpets Limited since July 2017, and a director of Gold Star Foods, a food distribution company, since April 2014. He is a former director of Shelf Drilling Inc., Caribbean Restaurants, LLC, International Energy Services, the Blue Star Group and Hercules Offshore, Inc. (OTC: HERO). Mr. Osman holds an M.B.A. from the Wharton Graduate School of Business, a Masters of Engineering from the University of Adelaide and a Masters of Applied Finance from Macquarie University.

We believe Mr. Osman is qualified to serve on our Board of Directors based on his leadership and business experience; his track record as a partner and managing director of Argand; and his network of contacts in the industrial manufacturing and services industry.

|

Bruce Young |

|

Director since 2018 |

Bruce Young, age 60, has served as our Chief Executive Officer and a member of our Board of Directors since the consummation of the Business Combination. Mr. Young has been the President and Chief Executive Officer of Brundage-Bone since 2008 and joined Brundage-Bone in 1985. Mr. Young was appointed as the Chief Executive Officer of the Brundage-Bone brand in 2008. Prior to that, Mr. Young managed the concrete pumping operations for Brundage-Bone from 2001 to 2008. Mr. Young has also served as Chief Executive Officer of Eco-Pan since its founding in 1999. Mr. Young started his career in the concrete pumping industry in 1980 with O’Brien Concrete Pumping, eventually moving on to start his own concrete pumping company.

We believe that Mr. Young is qualified to serve on our Board of Directors based on his historic knowledge of Brundage-Bone and his extensive industry experience.

14

|

M. Brent Stevens |

|

Director since 2018 |

M. Brent Stevens, age 59, has been a member of our Board of Directors since December 9, 2018. Mr. Stevens is the founder and Manager of Peninsula Pacific, a private investment fund focused on control investments in the gaming, consumer and industrial sectors. In connection with serving as Manager of Peninsula Pacific Mr. Stevens served as the Chairman and Chief Executive Officer of Peninsula Gaming, LLC, a company which he founded in 1997 and sold to Boyd Gaming Corporation in 2012. From 1990 through 2010, Mr. Stevens worked in the investment banking group of Jefferies & Company, holding various positions, most recently as an Executive Vice President and Head of Capital Markets. He also served as a member of Jefferies’ Executive Committee. Mr. Stevens received his B.A. in Accounting from the University of Southern California and holds an M.B.A. from the Wharton School at the University of Pennsylvania.

We believe Mr. Stevens is qualified to serve on our Board of Directors based on his business experience and strong background in finance.

15

PROPOSAL TWO: RATIFICATION OF APPOINTMENT OF BDO USA LLP AS

OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR OUR 2019 FISCAL YEAR

The Audit Committee has appointed BDO USA, LLP (“BDO”) to serve as our independent registered public accounting firm for our 2020 fiscal year and is soliciting your ratification of that appointment. BDO has served as our independent registered public accounting firm since 2018.

The Audit Committee has responsibility for appointing our independent registered public accounting firm and stockholder ratification is not required; however, as a matter of good corporate governance, the Audit Committee is soliciting your vote on this proposal. If the appointment of BDO is not ratified by the stockholders, the Audit Committee may appoint another independent registered public accounting firm or may decide to maintain its appointment of BDO. Even if the appointment is ratified, the Audit Committee may, in its discretion, appoint a different independent registered public accounting firm.

Representatives of BDO will be present at the Annual Meeting to make a statement, if they choose, and to respond to appropriate questions.

Our Audit Committee and Board of Directors unanimously recommend that you vote FOR the ratification of the appointment of BDO USA, LLP as our independent registered public accounting firm for our 2020 fiscal year.

16

AUDIT RELATED MATTERS

Audit Fees

The following table shows the fees for professional services rendered to us by BDO for services in respect of the years ended October 31, 2019 and 2018.

|

|

|

2019 |

|

|

2018 |

|

||

|

Audit Fees(1) |

|

$ |

1,232,680 |

|

|

$ |

632,544 |

|

|

Audit-Related Fees(2) |

|

|

- |

|

|

|

- |

|

|

Tax Fees(3) |

|

|

- |

|

|

|

- |

|

|

All other fees(4) |

|

|

- |

|

|

|

- |

|

|

Total |

|

$ |

1,232,680 |

|

|

$ |

632,544 |

|

|

|

(1) |

“Audit Fees” include fees and expenses billed for the audit of our consolidated financial statements, services provided in connection with statutory audits, and fees for services provided in connection with review of registration statements, comfort letters and consents. |

|

|

(2) |

“Audit-Related Fees” include fees billed for services that are reasonably related to the performance of the audit or review of our financial statements and are not reported above under the caption “Audit Fees.” These fees also include services for due diligence on acquisitions and divestitures. |

|

|

(3) |

“Tax Fees” include fees billed for services that are related to tax compliance and advice, including international tax consulting. |

|

|

(4) |

BDO did not provide any “other services” during the period. |

Pre-Approval Policies and Procedures

The Audit Committee has sole authority to engage and determine the compensation of our independent registered public accounting firm. The Audit Committee also is directly responsible for evaluating the independent registered public accounting firm, reviewing and evaluating the lead partner of the independent registered public accounting firm and overseeing the work of the independent registered public accounting firm. The Audit Committee annually pre-approves services to be provided by BDO, and also considers and is required to pre-approve the engagement of BDO for the provision of other services during the year. For each proposed service, the independent registered public accounting firm is required to provide detailed supporting documentation at the time of approval to permit the Audit Committee to make a determination as to whether the provision of such services would impair the independent registered public accounting firm’s independence, and whether the fees for the services are appropriate.

17

AUDIT COMMITTEE REPORT

The Audit Committee assists the Board of Directors with its oversight responsibilities regarding the Company’s financial reporting process. The Company’s management is responsible for the preparation, presentation and integrity of the Company’s financial statements and the reporting process, including the Company’s accounting policies, internal audit function, internal control over financial reporting and disclosure controls and procedures. BDO USA, LLP, the Company’s independent registered public accounting firm, is responsible for performing an audit of the Company’s financial statements.

With regard to the fiscal year ended October 31, 2019, the Audit Committee (i) reviewed and discussed with management our audited consolidated financial statements as of October 31, 2019, and for the fiscal year then ended; (ii) discussed with BDO USA, LLP the matters required by PCAOB AS Section 1301, Communications with Audit Committees; (iii) received the written disclosures and the letter from BDO USA, LLP required by applicable requirements of the PCAOB regarding BDO USA, LLP’s communications with the Audit Committee regarding independence; and (iv) discussed with BDO USA, LLP their independence.

Based on the review and discussions described above, the Audit Committee recommended to our Board of Directors that our audited financial statements be included in our Annual Report on Form 10-K for the fiscal year ended October 31, 2019, for filing with the Securities and Exchange Commission.

The Audit Committee:

John M. Piecuch (Chair)

David A.B. Brown

Raymond Cheesman

Changes in Independent Registered Public Accounting Firms

Effective February 28, 2019, the Audit Committee approved the dismissal of WithumSmith+Brown, PC (“Withum”) as the Company’s independent registered public accounting firm. The Audit Committee thereafter engaged BDO as the Company’s independent registered public accounting firm, effective on the same day. Prior to the Business Combination, Withum served as Industrea’s independent auditor and BDO served as CPH’s independent auditor.

During the period from April 7, 2017 (date of inception) to December 31, 2017, the period from January 1, 2018 through December 5, 2018 and the subsequent interim period through February 28, 2019, (i) there were no disagreements with Withum on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure that, if not resolved to the satisfaction of Withum, would have caused them to make reference to the subject matter of the disagreement in connection with its reports on the Company’s financial statements for such years, or (ii) “reportable events” as defined in Item 304(a)(1)(v) of Regulation S-K.

The reports of Withum on the Company’s financial statements as of and for the period from April 7, 2017 (date of inception) through December 31, 2017 and the period from January 1, 2018 through December 5, 2018 did not contain an adverse opinion or a disclaimer of opinion, and were not qualified or modified as to uncertainties, audit scope or accounting principles.

The Company provided Withum a copy of the above disclosures and requested that Withum furnish it with a letter addressed to the SEC stating whether or not it agrees with the above statements. A copy of such letter, dated February 28, 2019, was filed as Exhibit 16.1 to the Current Report on Form 8-K filed by the Company on March 4, 2019.

18

MANAGEMENT

The following table provides information regarding our executive officers, including their ages, as of the date of filing of this Proxy Statement:

|

Name |

|

Age |

|

Position |

|

Bruce Young |

|

60 |

|

Chief Executive Officer and Director |

|

Iain Humphries |

|

45 |

|

Chief Financial Officer and Director |

Mr. Young and Mr. Humphries’s biographical information is disclosed above in the section entitled “Proposal One: Election of Directors.”

EXECUTIVE COMPENSATION

This section discusses the material components of the executive compensation program for the Company’s executive officers who are named in the “Summary Compensation Table” below. In fiscal year 2019, the Company’s “named executive officers” or “NEOs” and their positions were as follows:

|

|

● |

Bruce Young, Chief Executive Officer; |

|

|

● |

Iain Humphries, Chief Financial Officer; and |

The Company’s NEOs are employed by, and receive cash compensation and employee benefits from Brundage-Bone Concrete Pumping, Inc. (“Brundage-Bone”), its wholly-owned subsidiary. For purposes of this discussion, references to cash compensation paid and employee benefits provided by the Company include the cash compensation and employee benefits paid or provided by Brundage-Bone.

19

Summary Compensation Table

The following table sets forth information concerning the compensation of the Company’s named executive officers for the Company’s fiscal years ending October 31, 2019 and 2018.

|

Name and Principal Position |

|

Year |

|

|

Salary |

|

|

Stock Awards (1) |

|

|

Non-Equity |

|

|

All Other |

|

|

Total |

|

||||||

|

Bruce Young |

|

|

2019 |

|

|

$ |

430,000 |

|

|

$ |

6,512,676 |

|

|

$ |

267,800 |

|

|

$ |

120,708 |

|

|

$ |

7,331,184 |

|

|

Chief Executive Officer |

|

|

2018 |

|

|

$ |

350,000 |

|

|

$ |

- |

|

|

$ |

92,400 |

|

|

$ |

26,692 |

|

|

$ |

469,092 |

|

|

Iain Humphries |

|

|

2019 |

|

|

$ |

295,000 |

|

|

$ |

4,151,209 |

|

|

$ |

155,800 |

|

|

$ |

840,546 |

|

|

$ |

5,442,555 |

|

|

Chief Financial Officer |

|

|

2018 |

|

|

$ |

265,000 |

|

|

$ |

- |

|

|

$ |

63,600 |

|

|

$ |

25,758 |

|

|

$ |

354,358 |

|

|

|

(1) |

Amounts reflect the full grant-date fair value of restricted stock of the Company’s common stock, calculated in accordance with FASB ASC Topic 718. For a discussion of the assumptions used to calculate the value of restricted stock awards, see Note 15 of the Company’s consolidated financial statements included in its Annual Report on Form 10-K for the year ended October 31, 2019.

For each of Messrs. Young and Humphries, this column includes $1,771,641 and $1,027,159, respectively, for market-based restricted stock awards that were granted on April 10, 2019 and will become available for vesting in three equal installments if the closing price of the common stock equals or exceeds $13.00, for 30 consecutive business days. Upon the achievement of this hurdle, the market-based restricted stock will vest in equal increments over the first, second and third anniversaries of the date on which the stock price target was achieved.

For each of Messrs. Young and Humphries, this column also includes $1,524,271 and $883,739, respectively, for market-based restricted stock awards that were granted on April 10, 2019 and that will become available for vesting in three equal installments if the closing price of the common stock equals or exceeds $16.00, for 30 consecutive business days. Upon the achievement of this hurdle, the market-based restricted stock will vest in equal increments over the first, second and third anniversaries of the date on which the stock price target was achieved.

For each of Messrs. Young and Humphries, this column also includes $1,321,296 and $766,060, respectively, for market-based restricted stock awards that were granted on April 10, 2019 and that will become available for vesting in three equal installments if the closing price of the common stock equals or exceeds $19.00, for 30 consecutive business days. Upon the achievement of this hurdle, the market-based restricted stock will vest in equal increments over the first, second and third anniversaries of the date on which the stock price target was achieved.

For each of Messrs. Young and Humphries, this column also includes $1,895,467 and $1,474,250, respectively, for restricted stock awards that were granted on April 10, 2019 and that will vest in five substantially equal installments on each of December 6, 2019, December 6, 2020, December 6, 2021, December 6, 2022 and December 6, 2023. |

|

|

(2) |

Amounts represent 2018 and 2019 cash bonuses earned by the Company’s named executive officers during fiscal year 2018 and 2019, respectively. The terms of such cash bonuses are described following this table. |

|

|

(3) |

Amounts under the “All Other Compensation” column consist of the following for fiscal year 2019: |

|

|

a. |