UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

(Amendment No. 1)

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): December 6, 2018

CONCRETE PUMPING HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 001-38166 | 83-1779605 |

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

6461 Downing Street

Denver, Colorado 80229

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code: (303) 289-7497

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company þ

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Explanatory Note

This Amendment No. 1 on Form 8-K/A (this “Amendment”) to the Current Report on Form 8-K of Concrete Pumping Holdings, Inc. (the “Company,” “we,” “us,” and “our”), originally filed with the U.S. Securities and Exchange Commission (the “SEC”) on December 10, 2018 (the “Original Form 8-K”), is being filed solely to amend and restate in their entirety Items 2.01 and 9.01 in the Original Form 8-K. No other changes have been made to the Original Form 8-K. References to “this Current Report on Form 8-K” are to the Original Form 8-K as amended by this Amendment.

Introductory Note

On December 6, 2018 (the “Closing Date”), the Company consummated the transactions contemplated by that certain Agreement and Plan of Merger, dated as of September 7, 2018 (the “Merger Agreement”), by and among the Company, Industrea Acquisition Corp., a Delaware corporation (“Industrea”), the private operating company formerly named Concrete Pumping Holdings, Inc., a Delaware corporation (“CPH”), and certain subsidiaries of the Company, pursuant to which (a) Concrete Pumping Merger Sub Inc., a Delaware corporation and a wholly owned indirect subsidiary of the Company (“Concrete Merger Sub”), merged with and into CPH, with CPH surviving the merger as a wholly owned indirect subsidiary of the Company (the “CPH Merger”), and (b) a wholly owned direct subsidiary of the Company merged with and into Industrea, with Industrea surviving the merger as a wholly owned subsidiary of the Company (the “Industrea Merger”). The transactions contemplated by the Merger Agreement are referred to herein as the “Business Combination.”

The Business Combination was completed on December 6, 2018. In connection with the Closing, the Company changed its name from Concrete Pumping Holdings Acquisition Corp. to Concrete Pumping Holdings, Inc.

Under the Merger Agreement, the Company indirectly acquired CPH for aggregate consideration of approximately $182.5 million in cash (excluding amounts deposited in escrow at Closing) and 13,947,323 shares of Company common stock (valued at $10.20 per share) that were issued in exchange for shares of CPH’s capital stock prior to the consummation of the CPH Merger pursuant to the Non-Management Rollover Agreement and that certain Management Rollover Agreement, dated September 7, 2018, by and among the Company, Industrea and members of CPH management party thereto (the “Management Rollover Agreement”). In addition, 2,783,479 CPH options were converted into options of the Company, and pursuant to the Industrea Merger, all of the issued and outstanding shares of Industrea common stock were exchanged on a one-for-one basis for shares of Company common stock, and all of the outstanding warrants to purchase Industrea common stock are exercisable for an equal number of shares of Company common stock on the existing terms and conditions of such warrants.

In addition, immediately prior to the Closing, (i) pursuant to that certain subscription agreement (the “Argand Subscription Agreement”), dated as of September 7, 2018, by and among the Company, Industrea and the Argand Investor, Industrea issued to the Argand Investor an aggregate of 5,333,333 shares of Industrea common stock for $10.20 per share, for an aggregate cash purchase price of $54.4 million, plus an additional 2,450,980 shares of Industrea common stock at $10.20 per share, for an aggregate cash purchase price of $25.0 million to offset redemptions of Industrea’s public shares in connection with the Business Combination (“Redemptions”); and (ii) pursuant to that certain subscription agreement (the “Common Stock Subscription Agreement”), dated as of September 7, 2018, Industrea issued to an accredited investor (the “Common Investor”) an aggregate of 1,715,686 shares of Industrea common stock at a price of $10.20 per share, for an aggregate cash purchase price of $17.5 million, plus an aggregate of 190,632 additional shares of Industrea common stock the (“Utilization Fee Shares”) as consideration for such investor’s agreement to purchase Industrea common stock. The shares of Industrea common stock issued to the Argand Investor and the Common Investor were exchanged on a one-for-one basis for shares of Company common stock at the Closing.

Pursuant to the Non-Management Rollover Agreement and the Common Stock Subscription Agreement, immediately prior to the Closing the Sponsor surrendered to the Company for cancellation for no consideration an aggregate of 1,202,925 shares of Industrea common stock.

| 2 |

In addition, on the Closing Date, pursuant to that certain subscription agreement, dated as of September 7, 2018 (the “Preferred Stock Subscription Agreement” and collectively with the Argand Subscription Agreement and the Common Stock Subscription Agreement, the “Subscription Agreements”), by and between the Company and Nuveen Alternatives Advisors, LLC (“Nuveen”), the Company issued to Nuveen 2,450,980 shares of the Company’s Series A Zero-Dividend Convertible Perpetual Preferred Stock (“Series A Preferred Stock”) at a price of $10.20 per share, for an aggregate cash purchase price of $25.0 million.

Item 2.01 Completion of Acquisition or Disposition of Assets.

The disclosure set forth in the “Introductory Note” above and in Item 2.01 “Completion of Acquisition or Disposition of Assets” in the Original Form 8-K is incorporated into this Item 2.01 by reference.

Cautionary Note Regarding Forward-Looking Statements

The Company makes and incorporates by reference forward-looking statements in this Current Report on Form 8-K. These forward-looking statements relate to expectations for future financial performance, business strategies or expectations for the Company’s business. Specifically, forward-looking statements may include statements relating to:

| · | the benefits of the Business Combination; |

| · | the future financial performance of the post-combination company following the Business Combination; |

| · | expansion plans and opportunities; and |

| · | other statements preceded by, followed by or that include the words “may,” “can,” “should,” “will,” “estimate,” “plan,” “project,” “forecast,” “intend,” “expect,” “anticipate,” “believe,” “seek,” “target” or similar expressions. |

These forward-looking statements are based on information available as of the date of this Current Report on Form 8-K and the Company’s management’s current expectations, forecasts and assumptions, and involve a number of judgments, risks and uncertainties. Accordingly, forward-looking statements should not be relied upon as representing the Company’s views as of any subsequent date. The Company does not undertake any obligation to update forward-looking statements to reflect events or circumstances after the date they were made, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

As a result of a number of known and unknown risks and uncertainties, the Company’s actual results or performance may be materially different from those expressed or implied by these forward-looking statements. Some factors that could cause actual results to differ include:

| · | the inability to maintain the listing of the Company common stock and warrants on the Nasdaq Stock Market (“Nasdaq”); |

| · | the risk that the Business Combination disrupts current plans and operations as a result of the announcement and consummation of the transactions described herein; |

| · | the ability to recognize the anticipated benefits of the Business Combination, which may be affected by, among other things, competition and the ability of the combined business to grow and manage growth profitably; |

| · | changes in applicable laws or regulations; |

| · | the possibility that the Company may be adversely affected by other economic, business, and/or competitive factors; and |

| · | other risks and uncertainties included or incorporated by reference in this Current Report on Form 8-K, including those set forth in the “Risk Factors” section in the proxy statement/prospectus included in the Company’s registration statement on Form S-4 (File No. 333-227259), as amended and supplemented, originally filed with the SEC on September 10, 2018 (as amended and supplemented, the “proxy statement/prospectus”), which is incorporated herein by reference. |

| 3 |

Business

The business of Industrea prior to the Business Combination is described in the proxy statement/prospectus in the section entitled “Information About Industrea,” which is incorporated herein by reference.

Information about CPH

CPH Business Overview

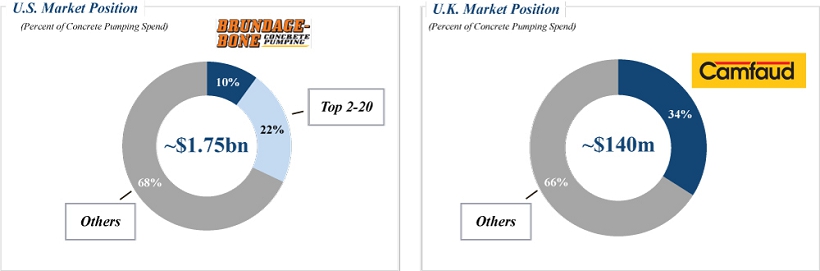

CPH is a leading provider of concrete pumping services in the highly fragmented U.S. and U.K. markets based on fleet size, operating under the only established, national brands in both markets (Brundage-Bone and Camfaud, respectively). Concrete pumping is a highly specialized method of concrete placement that requires highly-skilled operators to position a truck-mounted fully-articulating boom for precise delivery of ready-mix concrete from mixer trucks to placing crews on a job site. CPH’s large fleet of specialized pumping equipment and highly-trained operators position CPH to deliver concrete placement solutions that facilitate substantial labor cost savings to customers, shorten concrete placement times, enhance worksite safety and improve construction quality. CPH operates a fee-based revenue model with no bonding requirements.

Brundage-Bone was founded in 1983 by Jack Brundage and Dale Bone in Denver, Colorado. The co-founders, who set out to build the leading concrete pumping services company in the U.S., entered the Dallas market in 1984 and subsequently executed CPH’s first strategic acquisition in Seattle in 1986. Since its founding, CPH has completed more than 45 acquisitions expanding throughout the U.S., and in November 2016, CPH entered the U.K. market. Today, CPH is the number one player in every region it serves and is more than four times larger than the next competitor in the U.S. and approximately ten times larger than the next competitor in the U.K. based on fleet size. CPH’s industry includes approximately 1,000 regionally focused companies, many of which we believe are undercapitalized, utilize aged equipment and operate only smaller and significantly fewer boom pumps. In a typical market, CPH competes with only one or two other concrete pumping companies that can perform the larger and more complex projects that CPH can perform.

As the only nationally-scaled provider of concrete pumping in the U.S. and U.K. with 35-years of experience, CPH has the most comprehensive fleet and highly-skilled operators to provide quality service and is especially suited to support large and technically complex construction projects. CPH’s fleet’s size and breadth of operating capabilities allow CPH to target such larger and more complex jobs (which generally command higher price points) compared to smaller competitors with more limited fleet and operator resources, and also allows CPH to pursue multiple large projects concurrently. CPH has actively positioned its business towards commercial and infrastructure construction projects, while continuing to pursue profitable residential opportunities. CPH serves a large base of more than 8,000 customers with low customer concentration; CPH’s top 10 customers represented less than 10% of revenue in the fiscal year ended October 31, 2018. CPH is able to leverage its scale to move assets across the U.S. and the U.K. depending on which regions show stronger market conditions.

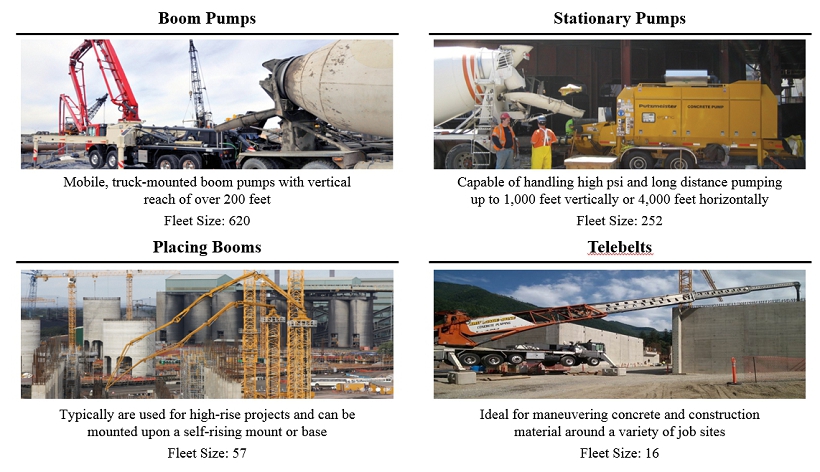

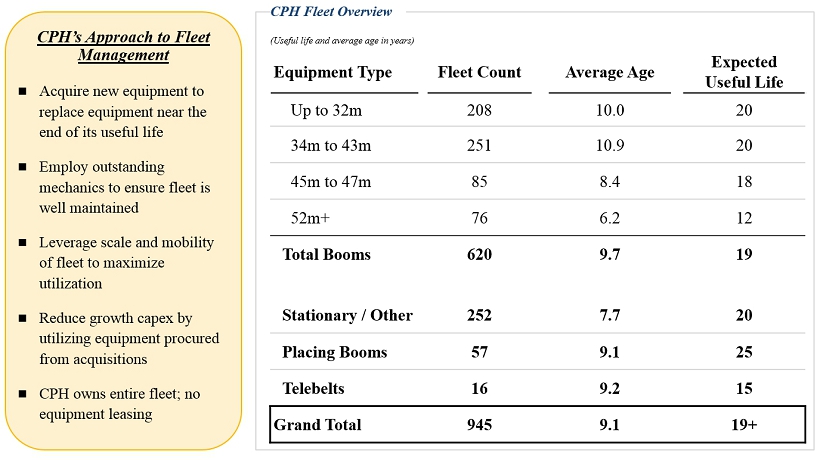

CPH’s fleet is operated by approximately 657 experienced employees as of October 31, 2018, each of whom is required to complete rigorous training and safety programs. As of October 31, 2018, CPH’s fleet of 945 total pieces of equipment consisted of 620 boom pumps, ranging in size from 17 to 65 meters, 57 placing booms, 16 telebelts and 252 stationary pumps and other specialized concrete placing equipment. CPH maintains the flexibility to move assets between branches depending on market conditions. CPH performs substantially all of its repair and maintenance work in-house through a staff of 92 mechanics so as to maximize fleet availability and performance levels. CPH operators are paid on an hourly basis and only when they are deployed on jobs, demonstrating CPH’s commitment to comprehensive and disciplined labor cost management. We estimate that 70% of CPH’s total costs are variable.

| 4 |

CPH is also the leading provider of concrete waste management services in the U.S. market based on fleet size, operating under the only established, national brand (Eco-Pan). After concrete is used at a construction site, the ready-mix trucks, concrete pump trucks and other equipment are required to be washed out to remove the remaining concrete before it hardens. U.S. federal and state environmental regulations regulate the safe and environmentally compliant disposal of this concrete waste (“washout”). CPH provides a full-service, cost-effective, regulatory-compliant solution to manage environmental issues caused by concrete washout, branded Eco-Pan, which is highly complementary to CPH’s core concrete pumping service. Eco-Pan provides a route-based solution that operates from 13 locations in the U.S. as of October 31, 2018, providing watertight pans to be used to collect concrete washout. Eco-Pan’s growth has been supported by heightened environmental regulations, potentially severe penalties on contractors who do not comply, and high costs associated with traditional labor-intensive concrete washout methods. CPH leverages its existing Brundage-Bone and Camfaud customers to cross-sell Eco-Pan as a value-added, cost-effective, regulatory-compliant solution to properly manage environmental issues caused by concrete.

For the fiscal year ended October 31, 2018, CPH generated revenues of $243.2 million and net income of $28.4 million.

CPH’s key service segments are summarized below:

U.S. Concrete Pumping — Brundage-Bone: CPH provides concrete pumping services in the U.S. with a fleet of 584 equipment units from a diversified footprint of 80 locations across 22 states as of October 31, 2018 and operates under the brand Brundage-Bone. CPH provides operated concrete pumping services, for which CPH bills customers on a negotiated time and volume basis based on the duration of the job and yards of concrete pumped. Additional charges (such as a fuel surcharge and travel costs) are frequently added based on the local market competitive environment and specific project requirements. Typically, CPH sends a single operator with each concrete pump. CPH does not take ownership of the concrete and thus has minimal inventory or product liability risk. CPH typically does not engage in fixed-bid work or have surety bonding requirements. CPH operates a daily fee-based revenue model regardless of project completion. Brundage-Bone is a leading provider of concrete pumping services in the U.S. based on fleet size and the only competitor with a multi-regional footprint in a highly fragmented industry. CPH’s large fleet of specialized pumping equipment and highly-trained operators position CPH to deliver concrete placement solutions that we believe facilitate substantial labor cost savings to its customers, shorten concrete placement times, enhance worksite safety and improve construction quality. CPH has actively positioned the Brundage-Bone business towards commercial and infrastructure construction projects, while continuing to pursue profitable residential opportunities.

U.K. Concrete Pumping — Camfaud: On November 17, 2016, CPH formed Oxford Pumping Holdings Ltd. to complete the stock acquisitions of two concrete pumping companies in the U.K.: Camfaud Concrete Pumps Limited, and Premier Concrete Pumping Limited, which each also owned 50% of the stock of South Coast Concrete Pumping Limited (together, the “Oxford Acquisitions”). Oxford Pumping Holdings Ltd. was a wholly-owned subsidiary of Brundage-Bone Concrete Pumping, Inc., which in turn is wholly owned by Concrete Pumping Intermediate Holdings, LLC. Following an internal restructuring, Oxford Pumping Holdings Ltd. changed its name to Camfaud Group Limited on April 3, 2018. CPH operates its business in the U.K. under the “Camfaud” brand name. Camfaud operates both a fixed and a mobile fleet. The fixed fleet business entails either (1) utilizing static line pumps with an accompanied operator, or (2) renting out the equipment on a long-term basis without an operator. Mobile equipment is charged to customers under a minimum hire rate (typically five to eight hours). The business model is similar to pumping in the U.S. In the U.K., CPH, under the Camfaud brand name, provides concrete pumping services with a fleet of 361 equipment units from 28 locations as of October 31, 2018. On July 3, 2017, CPH completed the stock acquisition of the U.K.-based company Reilly Concrete Pumping Ltd. (“Reilly”). The Reilly acquisition provides CPH with a more comprehensive footprint across the U.K., allowing the company to provide its diverse customer base with a truly national service offering on major infrastructure and commercial projects. Reilly’s mobile pump fleet totaled 45 pumps as of October 31, 2018.

| 5 |

Concrete Waste Management Services — Eco-Pan: Eco-Pan was founded in 1999 and was acquired by CPH in 2014. Eco-Pan’s services help its customers to comply with environmental regulations, avoid fines and reduce their compliance costs. Eco-Pan is a route-based solution that operates 60 trucks and more than 5,200 custom metal pans to construction sites from 13 locations in the U.S. as of October 31, 2018. Eco-Pan charges a round-trip delivery fee and weekly or monthly rental rate for its pans, which provides a turn-key solution to the customer compared to the alternative of bagging the waste concrete, pouring it into an on-site lined pit, or disposing of it into trash dumpsters and arranging for a pick-up. Eco-Pan delivers watertight pans to job sites to collect concrete washwater, and picks up the pans to deliver to recycling centers, passing disposal fees onto the customer. To the extent that pans are held at the job site for an extended number of days or irregular waste is found in the pan, Eco-Pan charges incremental fees. Eco-Pan’s trucks are designed to allow for the pick-up and re-delivery of multiple pans, leading to significant incremental efficiencies as “route densities” increase. We believe that Eco-Pan is highly complementary to Brundage-Bone, as customers’ decision makers for purchasing concrete pumping services also typically handle the disposal of waste concrete. Currently, Eco-Pan operates in 12 of the 22 major markets that Brundage-Bone serves, providing additional growth opportunities from rolling out Eco-Pan in the other Brundage-Bone geographies. We also believe that cross-selling of Eco-Pan services to Brundage-Bone’s customers is a substantial revenue growth opportunity for the combined company. The combination of the two businesses also presents the opportunity for cost-saving synergies, as in some cases the Brundage-Bone and Eco-Pan fleets can be co-located at the same facilities, serviced by a common set of mechanics, administered by the same office staff and marketed by the same salespeople, while increasing “route densities” for pan pick-ups and deliveries.

CPH Industry Overview

Industry Overview — Concrete Pumping

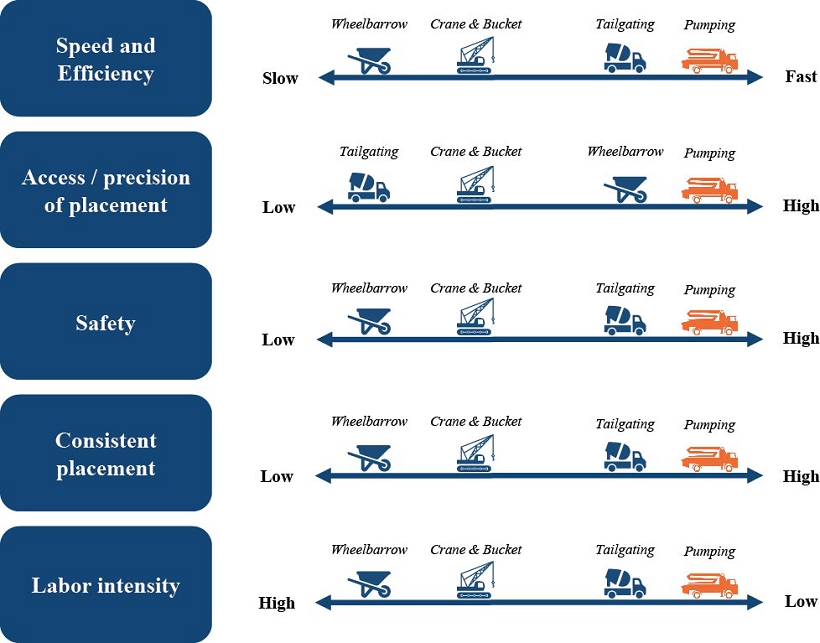

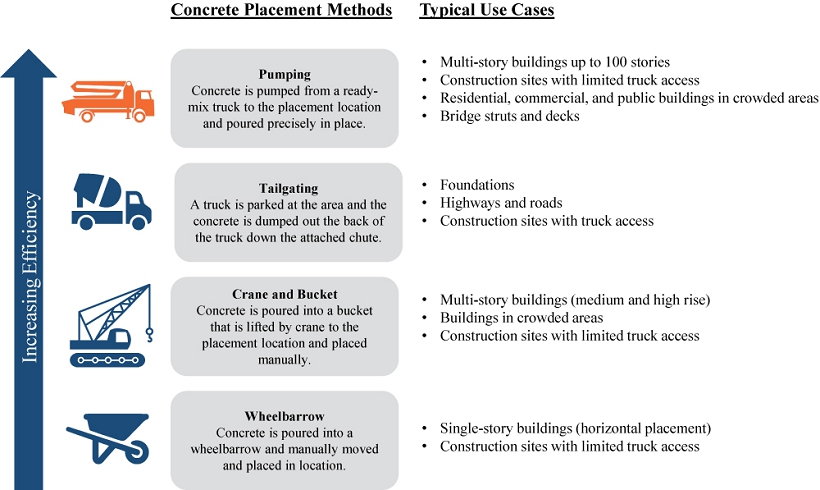

There are two primary methods of placing concrete when direct pouring (“tail-gating”) is not an option: traditional methods (such as using wheelbarrows and cranes and buckets) and concrete pumping. Traditional methods are both labor-intensive and time-intensive, requiring loading materials into containers, hauling the containers to the appropriate location and subsequently returning the containers to the concrete mixer to be re-filled. Concrete pumping, by contrast, provides a safer, more cost-effective and more time-efficient concrete placement solution, in which concrete is continuously pressure pumped through a boom and hose directly to the specified area. Except where direct pouring is feasible (such as for highways and level sites where a ready-mix truck can park within approximately 15 feet of the concrete installation), concrete pumping continues to be the method of choice over traditional concrete placement methods, as it lowers construction costs, shortens job times, allows for better access to challenging pour locations and enhances worksite safety. A concrete pump can empty a ready-mix concrete truck in as little as four minutes and has the technical capability of being able to place concrete at distances of up to 1,000 feet vertically and 4,000 feet horizontally. By contrast, traditional methods such as using wheelbarrows are more labor and time intensive with up to 200 wheelbarrow loads required to empty a ready-mix truck. Given this ability, concrete pumping is the placement method of choice for technical jobs or when concrete must be placed in harder-to-reach areas, including multi-story commercial and residential projects as well as infrastructure projects such as tunnels and bridges.

| 6 |

Advantages of Concrete Pumping

Concrete pumping represents only approximately 1-2% of overall project cost for medium and large jobs but is highly critical due to the highly-perishable nature of concrete, which has only an approximate 90-minute life before hardening. During this time, concrete must be transported from the concrete plant to the worksite before it starts to harden. Concrete can represent as much as 10-12% of total construction project cost, and the cost of concrete has steadily increased over the last several years in the U.S. A wasted batch of concrete is costly to the contractor, who must often work under a fixed budget and tight timeline. These dynamics make customers relatively price-inelastic with regards to concrete pumping services. Concrete pumping helps its contractor customers avoid the potentially costly headaches associated with traditional methods of concrete placement. Concrete pumping enables greater speed and efficiency, ability to access hard to reach areas, increased safety, enhanced consistency of the concrete pour, and less labor intensity as compared to alternatives.

| 7 |

Comparing Concrete Pumping to Other Methods of Concrete Placement

Concrete pumping is typically used for foundations, walls and floors of buildings. In particular, concrete pumping is well-suited for:

| · | Multi-story buildings: Buildings above grade cannot use tail-gating to pour concrete, and wheelbarrows and crane and bucket pouring are more labor-intensive and time-intensive; |

| · | Urban construction or areas with limited space: Concrete pumping requires less space and the equipment can be located farther from the construction site than tail-gating; |

| · | Projects with rapid turnaround times: Concrete pumping is faster than other placement methods as concrete pumps are capable of placing over 200 cubic yards of concrete per hour, emptying an entire ready-mix truck in as little as four minutes (similar time as tail-gating), as compared to 45 minutes needed to unload a truck using a crane and bucket; and |

| · | Large scale projects: Larger commercial, multi-family and public projects such as tunnels and bridges often use pumping to move large amounts of concrete in a shorter time compared to tail-gating, and are often constrained in smaller footprints which make it more difficult to place concrete in the middle of the site using traditional methods. |

| 8 |

Common Applications for Concrete Placement Methods

Selecting a Concrete Pumping Provider

Customers consider equipment availability, service reliability, technical expertise and safety to be key purchasing criteria when choosing a concrete pumping provider. Price is a lower level consideration given that the cost of pumping is typically only 1-2% of total project costs of medium and larger jobs, whereas the value in terms of labor saved, accurate placement, and enhanced safety is relatively high. Equipment availability is important as contractors want to avoid having to hire several companies if the project requires several pump types or specialty equipment. For more complex commercial or infrastructure jobs, contractors place a premium on concrete pumpers who can provide specialized equipment. Furthermore, contractors value technical expertise and a commitment to safety, as these factors influence the perception of reliability, which is critical to ensuring on-time projects and avoiding worksite incidents. Contractors cannot afford to hire an inexperienced operator who could potentially risk the job timeline. Concrete pumping companies can therefore differentiate themselves by offering a wide range of equipment, reliable, high-quality service and a high degree of safety and compliance.

Competition

The concrete pumping industry is highly fragmented. We believe there are approximately 1,000 industry participants in the United States, operating an average of seven pumps each, with few competitors having a multi-regional presence and no other competitor having a national presence.

Due to servicing requirements and equipment transportation costs, most competition is at the local level. We estimate that approximately 65-75% of the U.S. market is served by small, local providers. CPH is the largest multi-regional concrete pumping provider in the U.S. based on fleet size, serving 22 states as of October 31, 2018. We believe the next largest competitor has operations in four states. National and regional service providers such as CPH enjoy competitive advantages over smaller, independent providers, which do not have the financial resources to maintain and support a diverse equipment fleet.

We estimate that CPH is more than four times the size of its next largest competitor in the U.S., by fleet size. CPH has the largest and most diversified fleet in the industry, which increases availability and provides contractors assurance that CPH will have the equipment they require when they need it. While CPH has 469 boom pumps in the United States as of October 31, 2018, we believe the average local competitor has a fleet size of 5-10 pumps and regional competitors have an average 50-60 pumps each. Relative to the U.S., the U.K. has a higher proportion of regional players. CPH is the leader in every city and region of the U.K. and is approximately ten times larger than its next largest competitor, by fleet size.

| 9 |

Concrete Pumping Demand Growth in the U.S. and U.K.

The attractive price-value proposition of concrete pumping has played a key role in the growing penetration of the concrete pumping industry. We believe that concrete pumping services typically represent only approximately 1-2% of total project cost for medium to large construction jobs. Notwithstanding the low cost of concrete pumping, these services are deemed critical due to the highly perishable life of concrete (typically approximately 90 minutes) and the high cost that concrete can represent of total project costs (as much as 10-12% of total project cost). We believe that most concrete pumping customers are therefore relatively price inelastic with regard to finding a reliable method to execute on their concrete placement requirements.

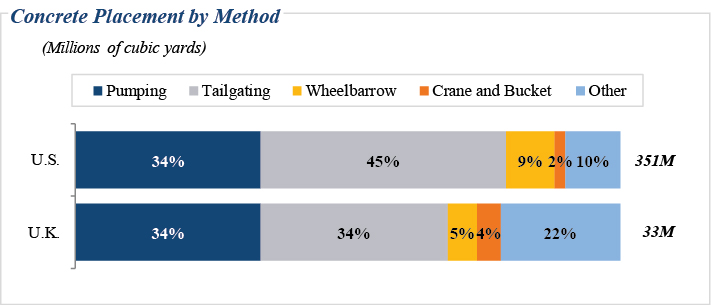

We believe that concrete pumping is estimated to represent 34% of total concrete placed in both the U.S. and U.K. This level of U.S. penetration is up from approximately 20% in 2000, but still meaningfully below estimated penetration levels of Continental Europe and the Middle East. We believe that the share of concrete pumping will continue to grow over the next decade. Growth in concrete pumping is expected to grow in the future and to be driven by several factors including commercial construction increasingly occurring in space constrained, urban areas (meaning less access for concrete trucks), residential developers building houses closer together to meet growing housing demand, urbanization trends continuing, construction labor costs continuing to increase as demand for skilled labor grows (which benefits concrete pumping given it is less labor-intensive than traditional concrete placement methods), and an increasing focus on worksite safety.

Concrete Placement by Method

Demand for concrete pumping is expected to continue to grow in both the U.S. and U.K. markets. Expenditures for concrete pumping are expected to grow by approximately 7% annually through 2021 in the U.S., and by approximately 2% annually through 2021 in the U.K., according to our projections. U.S. demand growth for concrete pumping is expected to be driven by positive trends in commercial, residential and infrastructure construction, as well as increases in penetration of concrete pumping as a percentage of overall concrete placement. Potential upside to forecasted growth of concrete pumping in the U.S. may result from U.S. tax reform and a potential infrastructure investment program. Growth of concrete pumping in the U.K. is expected to be supported by potential U.K. infrastructure investment programs including multiple phases of the $77 billion High-Speed Rail 2 project.

| 10 |

Pumped Concrete Demand in the U.S. and U.K.

Industry Overview — Concrete Waste Management Services

After concrete is used at a construction site, the ready-mix trucks, concrete pump trucks and other equipment must be washed out to remove the remaining concrete before it hardens. Concrete washout water (or “washwater”) is a slurry that contains toxic metals, is highly caustic and corrosive and contains elevated pH levels near 12 (compared to water at 7). Washwater can be harmful for wildlife, inhibit plant growth and contaminate groundwater. If not properly disposed of, washwater can percolate down through the soil, altering soil chemistry, and run off the construction site to adjoining roadside storm drains that discharge to rivers, lakes, or inlets. The U.S. Environmental Protection Agency (“EPA”) provides regulations for construction storm water management in the U.S. as regulated by the Clean Water Act and the Safe Drinking Water Act. The EPA ensures compliance with national regulations via on-site compliance monitoring, including on-site inspections and investigations of permits, off-site compliance monitoring such as data collection, program coordination and oversight, and support and solutions for overburdened communities. The EPA mandates that construction sites collect and retain all the concrete washwater and solids in leakproof containers to prevent the caustic material from contaminating ground or surface water. While EPA regulations serve as a national standard, states are ultimately responsible for enforcement within their borders, and many states have more stringent regulations than the EPA standard. For example, California, Washington, Oregon and Colorado have strict regulations requiring washout storage containers to be inspected prior to use, while Arizona, Florida and Texas hold the contractor responsible for daily inspections of the waste storage vicinity. Regulatory authorities can impose severe fines of up to $250,000 on contractors that do not comply. Environmental enforcement has increased significantly over the last decade, posing a major challenge for construction contractors.

As regulations and the density of construction projects increase, we believe contractors and builders are increasingly looking for waste management service providers who can provide turnkey solutions that manage washout collection and disposal. Larger builders and contractors are typically earlier adopters of such turnkey solutions, increasing awareness for mid-tier and local contractors who see the solutions working on-site.

Schedule of Permit Violations of the Clean Water Act

Source: U.S. Environmental Protection Agency.

| 11 |

Options for Concrete Washwater Containment

Concrete washout management services allow contractors to outsource the management of concrete waste. In addition to regulatory considerations, washout management services enable contractors to more effectively allocate their workforce to higher priority activities on the job site, alleviating the increasing labor costs which have hindered the construction industry. We believe that washout management services, including Eco-Pan’s offering, currently collect an estimated 10-15% of concrete washout volume generated in the U.S. Alternative solutions include self-managed washout pits (an estimated 38% of the market), washout roll-off bins (an estimated 31% of the market), dumpsters, vinyl and hay bale pits, plastic pits, or no solution (e.g. illegal dumping). These alternatives are typically less mobile, messier, and are often not leak-proof.

Methods of Concrete Washout Management

We believe that CPH’s proprietary Eco-Pan washout pans comprise a unique, disruptive washout management solution. Eco-Pan is a route-based, full-service, leak-proof system that allows for regulatory-compliant and cost-effective capture and recycling of concrete washwater. Eco-Pan delivers watertight and sealable metal pans to job sites where contractors use the pans to collect concrete waste, then Eco-Pan picks up the filled pans and delivers the washwater to authorized recycling facilities. Relative to Eco-Pan, alternatives may result in a higher risk of overflowing, thereby risking fines for contractors operating the site, require more labor to manage, require a larger footprint or lack on-site mobility.

Selecting a Concrete Washwater Containment Provider

We believe that the key factors driving a contractor’s decision in selecting a concrete washwater containment solution include: a desire for a simple concrete waste management solution, a requirement to meet environmental regulations and avoid penalties, a reasonable price-value proposition (though price is not the main deciding factor), a small physical footprint, convenient scheduling and a clean worksite to promote efficiency and safety.

| 12 |

Key Customer Decision-making Factors — Concrete Washout Management

We believe Eco-Pan ranks high on all of customers’ key decision-making criteria above, on the basis of Eco-Pan’s full-service, leak-proof system that allows for regulatory-compliant and cost-effective capture and recycling of concrete washwater. Eco-Pan further requires a small physical footprint (particularly as compared to traditional alternatives such as washout pits) and offers customers convenient and frequent delivery and pick-up times. The level of convenience offered to Eco-Pan customers is further supported by the route-density Eco-Pan is able to achieve as the only national scaled player in the market.

Eco-Pan Key Benefits To Customers

| 13 |

CPH Competitive Strengths

Market Leader in the U.S. and U.K.

CPH is the #1 concrete pumping provider in every region it serves, and is more than four times larger than its next competitor in the U.S. (with approximately 10% market share) and approximately ten times larger than its next competitor in the U.K (with approximately 34% market share). Most of CPH’s competitors only serve local areas and lack breadth of equipment. Few regional competitors serve more than two states or markets, whereas CPH’s large diverse fleet and national reach support differentiated, high-quality service.

CPH Market Share in the U.S. and U.K. — Concrete Pumping

Note: Market position based on LTM revenue as of October 31, 2018. Analysis is pro forma for the financial impact of the April 2018 O’Brien acquisition (approximately $14 million of revenue on an LTM basis as of April 2018, all of which were earned providing concrete pumping services in the U.S.). U.K. (Camfaud) LTM revenue assumes constant currency adjustment based on a GBP to USD exchange rate of 1.370.

Compelling Customer Value Proposition

Customers tend to choose CPH because of its differentiated capabilities that ensure equipment and operator availability, reliable and high-quality service, and strict safety and environmental compliance. CPH strives to provide contractors with the most effective pumping equipment for their particular needs, operated by highly-trained operators that can be quickly dispatched to the job-site. Concrete pumps provide a critical service to CPH’s customers, as CPH’s equipment must arrive at the construction site before the ready-mix concrete trucks to prevent worksite delays and rejection of wet batches of concrete. Any service delays can interrupt construction, resulting in incremental costs for CPH’s customers related to stalled labor, equipment and materials, all of which typically greatly exceed the cost of concrete pumping. CPH’s regional structure, combined with its analytical tools, provide visibility to the utilization and profitability of its fleet nationwide, allowing CPH to respond efficiently to local customer needs and market trends as they develop. Additionally, CPH’s rigorous maintenance and repair program performed by CPH’s on-staff mechanics results in reduced equipment downtime and a high-level of equipment reliability for CPH’s customers. CPH is dedicated to its comprehensive recruitment, training, safety and retention programs, and CPH strives to be the employer of choice for talented employees in the concrete pumping industry. CPH also offers its customers a unique, full-service, leak-proof system that allows for regulatory-compliant and cost-effective capture and recycling of concrete washwater.

| 14 |

Customer Value Proposition

Considerable Benefits of Scale

CPH maintains the largest pumping equipment fleet with 620 boom pumps across 80 branches in the U.S. and 28 branches in the U.K., as of October 31, 2018. CPH’s large and diversified fleet (which includes specialty equipment such as placing booms and telebelts of different sizes) increases availability, providing contractors assurance that CPH will have the equipment they require when they need it. The average local competitor has a fleet size of 5-10 pumps and regional competitors have an average of 50-60 pumps. Each local market typically has only one to three scale players. Because CPH faces limited competition with regards to the size and type of fleet and operators necessary for pumping jobs, and even less competition capable of performing multiple large jobs simultaneously, CPH is often able to price its services at higher hourly and yardage rates while delivering substantial value and flexibility to its customers. Furthermore, CPH’s scale allows it to efficiently move equipment around the country to areas with the highest local demand, which helps maximize equipment utilization rates and pricing. Finally, CPH’s scale allows for favorable pricing terms with equipment suppliers. Due to the significant investment and time required to develop a large-scale fleet, technical expertise, customer base and broad operating footprint, we believe that none of our competitors or potential market entrants currently has the capability to replicate CPH’s service and fleet offering in the near term.

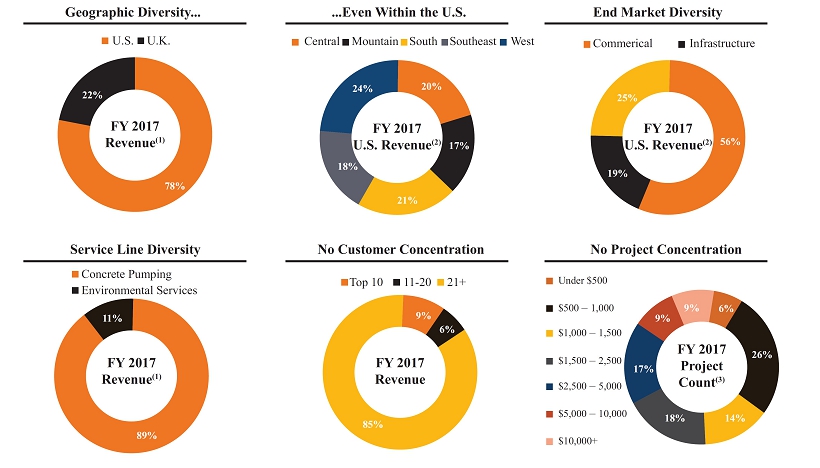

Platform with Significant Diversity

CPH’s broad geographic footprint, multiple service offerings, and exposure to three different end-markets provides significant operational diversity. This diversity is a key source of resiliency against changing market conditions.

| 15 |

Diverse Platform

Note: Revenue excludes contribution from the April 2018 O’Brien acquisition (approximately $14 million of revenue in FY 2017, all of which were earned providing concrete pumping services in the U.S.). CPH has an October fiscal year end.

(1) Analysis is pro forma adjusted for a full year contribution of CPH’s U.K. segment (Camfaud), which was acquired in November 2016, and assumes a constant currency adjustment based on a GBP to USD exchange rate of 1.370.

(2) U.S. revenue breakdown based on concrete pumping operations only.

(3) Project count based on U.S. and U.K. concrete pumping operations only. Figures do not sum to 100% due to rounding.

Service Oriented Business Model with Strong Cash Flow Characteristics

CPH is a construction services business that provides specialized equipment with highly-trained operators. We believe our customers are much more focused on quality and timeliness of service than on price, and tend not to be as price sensitive as the cost of CPH’s services is generally not significant relative to the cost of the overall concrete placement of a construction project. Additionally, CPH’s equipment, on average, has a useful life of 10 to 25 years, which is significantly longer than the useful lives of most general construction equipment. In periods during which CPH’s fleet is less active, CPH incurs less labor, service and fuel costs, all of which are driven by the aggregate number of hours that CPH bills its customers. We estimate that 70% of CPH’s costs are variable, which we believe allows CPH to better adapt to fluctuations in economic cycles. Furthermore, CPH is able to generate significant cash through the sale of its aged assets in the global secondary market for pumping equipment. Through CPH’s proprietary analytical tools, CPH is able to deploy its fleet to meet specific client demands and maximize efficiency, which has contributed to CPH’s improved utilization of its fleet. We believe that CPH’s substantial asset base and high degree of operational flexibility allow it to generate positive operating cash flow throughout the business cycle. Since CPH does not take ownership of concrete or require any significant inventory, CPH has very limited working capital requirements, which further enhances its ability to generate positive operating cash flow throughout the economic cycle.

| 16 |

Loyal and Diverse Customer Base

CPH develops and maintains deep relationships with customers, many of whom have been using CPH’s services for decades. We believe that CPH’s commitment to provide its customers with consistent, high-quality service has resulted in a broad and diverse customer base, including national and regional contractors and local leaders in their respective geographies. CPH executes a high-volume of small and mid-size jobs across all end-markets that provide substantial and stable revenue with no customer concentration. CPH serves a base of more than 8,000 customers (often with several projects per customer) and has an approximate 95% customer retention rate based on the top 500 customers, as of October 31, 2018. The top 10 customers represent less than 10% of revenues and have an average tenure of more than 20 years. We believe the loyalty of CPH’s customers is the result of its high-quality, professional services and the attractive value proposition that it offers.

Eco-Pan Provides Waste Management Solution to Largely Unmet Market Needs

Eco-Pan is a rapidly growing, turn-key solution that ensures contractors remain in compliance with environmental regulations. Eco-Pan has grown rapidly as a result of increased enforcement of environmental regulations. Eco-Pan significantly reduces the likelihood of environmental incidents that can result in costly fines, while also being competitively priced to alternative solutions and reducing labor requirements for contractors. We believe that Eco-Pan is highly complementary to Brundage-Bone, as customers’ decision makers for purchasing concrete pumping services also typically handle the disposal of waste concrete. Currently, Eco-Pan operates in 12 of the 22 major markets that Brundage-Bone serves, providing additional growth opportunities from rolling out Eco-Pan in the other Brundage-Bone geographies. We also believe that cross-selling of Eco-Pan services to Brundage-Bone’s customers is a substantial revenue growth opportunity for the combined company. The combination of the two businesses also presents the opportunity for cost-saving synergies, as in some cases the Brundage-Bone and Eco-Pan fleets can be co-located at the same facilities, serviced by a common set of mechanics, administered by the same office staff and marketed by the same salespeople, while increasing “route densities” for pan pick-ups and deliveries. Furthermore, CPH intends to explore expanding Eco-Pan into the U.K., which represents an additional growth opportunity.

Eco-Pan’s Competitive Advantages Include Route Density, a Well-Recognized Brand, Existing Customer Relationships, Strong Product Attributes and A Focus On Compliance

Eco-Pan has several key competitive advantages that are expected to support its continued growth and protect its leading market position:

| · | Scale and route density: Eco-Pan is the only national player of scale in the concrete washout management sector. Given Eco-Pan has more customers per region compared to competitors, it enjoys the benefits of greater route density. |

| · | Brand recognition: Eco-Pan has established strong brand recognition in the markets it serves, with limited competition from smaller, primarily local providers. |

| · | Existing customer relationships: Eco-Pan is synergistic with the CPH concrete pumping customer base, as it is able to leverage the same footprint and sell a bundled service that spans a greater portion of the construction project’s lifecycle. |

| · | Intellectual property: CPH has developed proprietary IP and know-how surrounding spill-free and leak-proof pans. Eco-Pan’s washout pans offer advantages over those of alternatives, with lids to prevent rainwater from over-flowing the pans and to prevent spills during transit. |

| · | Regulatory compliance: Eco-Pan is a proven solution that complies with all federal, state and local regulations. It is also LEED accredited, ensuring all concrete waste is disposed of at approved recycling facilities. |

| 17 |

Successful Track Record of Executing and Integrating Acquisitions

CPH has a strong track-record of identifying, executing and integrating acquisitions. Since 1983, CPH has executed over 45 acquisitions, which has allowed CPH to expand its end-market, service offerings and geographic reach. CPH derives acquisition synergies through increasing utilization of acquired pumps, achieving higher revenue per hour due to CPH’s greater pump availability and service levels, leveraging proprietary job costing tools, reducing purchasing and overhead costs, and capitalizing on cross selling opportunities with Eco-Pan. Additionally, as the only national provider of concrete pumping, CPH is often the only bidder or exit opportunity for local firms and is able to acquire companies at attractive valuations of pre-synergy LTM Adjusted EBITDA multiples of 4.5x or less, and 3.5x or less on a post-synergy basis.

Proven and Experienced Management Team

We are led by a highly tenured and experienced management team with significant industry experience. Our management team demonstrated its ability to source, acquire and integrate attractive acquisitions:

| · | Bruce Young (CEO) has led CPH in his current role for the past 10 years; Mr. Young’s experience in concrete pumping dates back to 1980. |

| · | Iain Humphries (CFO) joined CPH in 2016; Mr. Humphries has over 20 years of experience in international finance and management leadership. |

| · | Tony Faud (Managing Director, U.K.) manages all of CPH’s U.K. operations and has over 30 years of concrete pumping experience. |

CPH’s Business Strategy

Leverage Eco-Pan Across CPH’s Operating Footprint

CPH’s concrete pumping and Eco-Pan businesses provide highly complementary services to a similar customer base, as the decision maker responsible for purchasing concrete pumping services is generally also responsible for the disposal of concrete waste. According to our management’s market assessment, managed solutions for washwater (including Eco-Pan) comprise approximately 15% of the total U.S. market of approximately $850 million. We estimate Eco-Pan’s current penetration at 3 – 4%, leaving significant potential for further penetration and cross-selling across CPH’s concrete pumping customer base. Eco-Pan is currently only rolled out in 11 U.S. states as of October 31, 2018 (all of which overlap with Brundage-Bone except for Washington D.C.). Furthermore, CPH intends to expand the Eco-Pan service in the U.K.

Continue to Pursue Accretive Acquisitions

CPH has a successful track record as a consolidator in the sector, having executed more than 45 accretive acquisitions since 1983. Concrete pumping represents a highly fragmented market. As the leading national provider, CPH is often contacted by its regional competitors, which are often led by founders seeking succession and/or exit strategies. CPH has been able to purchase the assets of former competitors at typical LTM Adjusted EBITDA valuations of approximately 4.5x or less on a pre-synergy basis and 3.5x or less on a post-synergy basis. CPH derives acquisition synergies from increasing equipment utilization, optimizing pricing, leveraging data analytics tools, generating purchasing synergies, rationalizing excess overhead costs and cross-selling Eco-Pan. CPH has a robust M&A pipeline that it will continue to pursue.

Expand into New Markets and Adjacent Services

With the 2016 acquisition of Camfaud as a template for successfully entering a new geographic market, CPH plans to explore leveraging acquisitions to expand internationally into Australia, Canada, Continental Europe and the Middle East. Additionally, with Eco-Pan as a template for successfully entering a new service offering, CPH is exploring expanding into adjacent services to cross-sell across its existing customer base, including tower crane rental.

| 18 |

Prioritize Larger, More Complex Projects

With CPH’s extensive equipment fleet and technical expertise, CPH will continue to pursue many of the largest, most complex commercial and infrastructure projects, such as high-rise buildings, tunnels, highway overpasses, water treatment facilities, wind farms and other industrial developments. Larger jobs require, on average, larger boom pumps, multiple pumping units and deployment of such equipment for longer periods of time. Because CPH faces limited competition that has the type of fleet and operators necessary for these jobs, and even less competition capable of performing multiple large jobs simultaneously, CPH is often able to price its services for this work at higher hourly and yardage rates while delivering substantial value to its customers. We believe CPH’s competitive advantages will allow it to continue to capture more of this work as commercial and infrastructure construction spending continues to rebound. At the same time, given its geographic breadth and leadership position in multiple markets across the U.S. and the U.K., CPH plans to continue to maintain a high degree of customer and project diversity.

Unique Capabilities to Service Any Type of Project

Source: FMI’s Construction Outlook.

Note: Single-Family Residential includes spend on improvements. Commercial includes Multi-Family Residential

| (1) | US revenue breakdown based on concrete pumping operations only. |

Improve Margins by Optimizing Fleet Mix

CPH intends to maintain its disciplined policy of remaining current on fleet repair and maintenance costs in order to maximize uptime, reliability and service levels for its customers. Going forward, CPH’s capital expenditures strategy will focus on balancing the mix of small versus large boom pumps, growing and enhancing the fleet size at a pace in line with revenue growth, and maintaining an appropriate fleet age. Through the financial downturn, CPH aggressively sold older pumps and were able to keep its best-maintained, highest-valued equipment.

Maintain Disciplined Pricing Policies and Cost Controls

CPH intends to continue rigorous cost controls to continue to optimize pricing and streamline fixed costs. CPH’s proprietary job-costing analytical tools have allowed it to better understand profitability by customer and optimally price jobs based on the underlying cost structure of various jobs. While the majority of CPH’s jobs are based on purchase orders, some of its larger customers’ jobs are under six to twelve-month pricing agreements. As these arrangements continue to come up for renewal, CPH intends to continue to use its proprietary analytical tools to re-price work competitively to take advantage of improvements in market dynamics and underlying economic conditions as CPH continues to implement its diligent approach to cost management. CPH owns all of its equipment and has no outstanding operating leases. CPH intends to continuously look for further areas of pricing and cost improvement. CPH plans to further grow by rolling out its proprietary job-costing analytical tools in its U.K. business.

| 19 |

Continue to Lead Industry in Recruiting, Training and Safety

The success of CPH’s strategies ultimately depends on people, and CPH strives to be the employer of choice for highly motivated and skilled equipment operators. CPH will continue to emphasize its comprehensive training program and superior workplace safety record as providing a distinct advantage over competitors. We believe that CPH is the only multi-state concrete pumping company with a comprehensive in-house training program, dedicated safety directors and designated safety trainers in each branch. CPH will continue to provide its robust safety and risk management program, including in-house and field safety training for all of its employees and safety seminars, as well as site visits for all operators. CPH has experienced continuous improvement on its Total Recordable Incident Rate (“TRIR”) and Experience Modification Rate (“EMR”) statistics, which were 2.62 and 0.97 as of October 31, 2018, respectively. For the last two years, CPH’s TRIR has been continually improving as CPH has implemented safety initiatives to help ensure employees are safe on job sites. Brundage-Bone’s TRIR rating is substantially better than the U.S. industry average. CPH’s skilled employees and safety record are repeatedly cited as an important criterion for contractors that select CPH as a vendor. CPH will continue to focus on maintaining the ability of its trained operators to deliver safe, timely, premium quality concrete pumping services to its customers.

Geographic Footprint and Facilities

Headquartered in Denver, Colorado, CPH operates from a base of approximately 80 locations in 22 states in the U.S. and 28 locations in the U.K. as of October 31, 2018. CPH owns 18 locations in the United States. CPH leases primary branch facilities pursuant to the terms of the Master Lease described under “Certain Relationships and Related Person Transactions” and also leases satellite properties from which pumps are dispatched. Brundage-Bone leases 54 locations, Eco-Pan leases 8 locations and Camfaud leases 28 locations. Certain facilities are shared between Brundage-Bone and Eco-Pan and certain locations operate at construction sites without a formal lease.

Facilities

As of October 31, 2018.

| 20 |

Equipment

We believe that we own the most comprehensive fleet of concrete placement equipment in North America. With the industry’s largest, most technically advanced fleet, and a staff of highly trained and experienced operators, CPH is well-equipped to execute on the largest and most complex projects in both the U.S. and the U.K. Concrete pumps typically come in size ranges between 17 and 65 meters. CPH owns 100% of its fleet with an average fleet age of approximately nine years old as of October 31, 2018. We believe that most pieces of equipment can be extended out to useful lives of twenty years. CPH’s scale and robust in-house equipment servicing through highly-skilled mechanics ensure clients have consistent access to a breadth of specialized equipment. Further, CPH has a track record of keeping its fleet up-to-date through both investments in its fleet as well as through acquisitions of competitors, which are often structured as asset purchases that can offset growth capital expenditures, resulting in a higher return on assets than buying new units. We believe CPH’s scale and breadth of capabilities create a significant barrier to entry, as most competitors are not as well capitalized and are unable to replicate this offering. As of October 31, 2018, CPH’s concrete pumping equipment fleet is illustrated below.

Concrete Pumping Equipment Fleet

Note: Stationary pumps includes other equipment.

| 21 |

Note: Fleet profile as of October 31, 2018. Includes the impact of April 2018 O’Brien acquisition.

Customers

CPH has built a large, diverse, and loyal customer base across the U.S. and the U.K. During the fiscal year ended October 31, 2018, CPH served a base of more than 8,000 customers (often with several projects per customer) and had an approximate 95% customer retention rate from prior year based on its top 500 customers. CPH’s top 10 customers represented less than 10% of revenues and had an average tenure of more than 20 years. CPH’s customer composition varies from year to year and is largely dependent on geographic location and general economic and construction market trends within its operating regions. CPH actively monitors regional trends and targets customers in fast-growing markets through its extensive geographic footprint and knowledge of each local construction market in each region.

CPH’s customers consist of contractors or concrete contractors that span across the commercial, infrastructure and residential end markets. CPH also sells replacement parts to smaller competitors that lack the capital and scale to independently maintain a sufficiently stocked replacement parts inventory. The contractual arrangements with customers are typically on a project-to-project purchase order basis.

Suppliers

CPH primarily purchases pumping equipment, replacement parts, and fuel for its day-to-day operations. CPH sources its concrete pumping equipment primarily from two suppliers, but there are a number of other suppliers and CPH is not dependent upon any single supplier. We believe that CPH is the industry’s largest consumer of concrete pumping supplies and, as such, has significant purchasing leverage. For example, CPH typically purchases fuel in bulk at favorable prices and utilizes onsite fuel storage facilities.

CPH’s key suppliers include the two leading concrete pump manufacturers, Schwing and Putzmeister. We believe that CPH remains a valued customer for key industry suppliers, ensuring CPH’s ability to purchase equipment, parts and supplies on favorable terms, relative to competitors. We believe the market for supplying equipment used in CPH’s business is increasingly competitive.

| 22 |

Employees

As of October 31, 2018, CPH had over 1,100 employees across the U.S. and the U.K., over 800 of whom are highly-skilled equipment operators and mechanics. CPH employees are highly experienced, with an average tenure for pump operators of over five years. Additionally, CPH has regional managers who, on average, have approximately 30 years of experience in the concrete pumping industry. CPH maintains a “gold standard” training program ensuring all operators can meet the requirements of any project. Operators are trained in concrete pumping as well as in basic mechanical repair, while shop managers are trained in inspection and maintenance of all critical truck systems.

Approximately 100 employees in CPH’s workforce are unionized across California, Oregon and Washington. These individuals are represented by the International Union of Operating Engineers (“IUOE”) under three separate collective bargaining agreements. CPH has historically maintained favorable relations with the IUOE, under which its operators are organized, and has not experienced any significant disputes, disagreements, strikes or work stoppages.

Safety

To our management’s knowledge, CPH is the only concrete pumping company in the U.S. and the U.K. with a comprehensive, active safety program, an in-house safety department including dedicated safety directors at the corporate level, and a designated safety trainer at each branch. CPH is consistently recognized by key vendors and industry organizations (i.e., Association for General Contractors of America) for its commitment to safety. As part of CPH’s comprehensive safety management program, CPH actively tracks key safety performance indicators at each branch location to monitor safety performance, and takes corrective action when needed. Over the last two years, CPH’s TRIR has continually improved in the U.S. and U.K., with safety ratings that are significantly better than industry standards.

Legal Proceedings

CPH is a defendant in certain legal matters arising in the ordinary course of business. Based on available information, we are unable to estimate the costs, if any, to be incurred upon disposition of these matters, and therefore no provision for loss has been made. However, we believe the outcome of these matters is not likely to have a material effect on CPH’s future financial position, results of operations or cash flows.

Environmental Matters

CPH is subject to various federal, state and local and environmental laws and regulations, including those governing the discharge of pollutants into the air or water, the management, storage and disposal of, or exposure to, hazardous substances and wastes, the responsibility to investigate and clean up contamination, and occupational health and safety. Fines and penalties may be imposed for non-compliance with applicable environmental, health and safety requirements and the failure to have or to comply with the terms and conditions of required permits. We are not aware of any material instances of non-compliance with respect to environmental regulations.

Risk Factors

Risks Related to the Company’s Business and Operations

The Company’s business is cyclical in nature and a slowdown in the economic recovery or a decrease in general economic activity could have a material adverse effect on the Company’s revenues and operating results.

Substantially all of the Company’s customer base comes from the commercial, infrastructure and residential construction markets. A worsening of economic conditions or a decrease in available capital for investments could cause weakness in the Company’s end markets, cause declines in construction and industrial activity, and adversely affect the Company’s revenue and operating results.

| 23 |

The following factors, among others, may cause weakness in the Company’s end markets, either temporarily or long-term:

| • | the depth and duration of an economic downturn and lack of availability of credit; |

| • | uncertainty regarding global, regional or sovereign economic conditions; |

| • | reductions in corporate spending for plants and facilities or government spending for infrastructure projects; |

| • | the cyclical nature of the Company’s customers’ businesses, particularly those operating in the commercial, infrastructure and residential construction sectors; |

| • | an increase in the cost of construction materials; |

| • | a decrease in investment in certain of the Company’s key geographic markets; |

| • | an increase in interest rates; |

| • | an overcapacity in the businesses that drive the need for construction; |

| • | adverse weather conditions, which may temporarily affect a particular region or regions; |

| • | reduced construction activity in the Company’s end markets; |

| • | terrorism or hostilities involving the United States or the United Kingdom; change in structural construction designs of buildings (e.g., wood versus concrete); and |

| • | oversupply of equipment or new entrants into the market causing pricing pressure. |

A downturn in any of the Company’s end markets in one or more of the Company’s geographic markets caused by these or other factors could have a material adverse effect on the Company’s business, financial conditions, results of operations and cash flows.

The Company’s business is seasonal and subject to adverse weather.

Since the Company’s business is primarily conducted outdoors, erratic weather patterns, seasonal changes and other weather related conditions affect the Company’s business. Adverse weather conditions, including hurricanes and tropical storms, cold weather, snow, and heavy or sustained rainfall, reduce construction activity, restrict the demand for the Company’s products and services, and impede the Company’s ability to deliver and pump concrete efficiently or at all. In addition, severe drought conditions can restrict available water supplies and restrict production. Consequently, these events could adversely affect the Company’s business, financial condition, results of operations, liquidity and cash flows.

The Company’s revenue and operating results have varied historically from period to period and any unexpected periods of decline could result in an overall decline in the Company’s available cash flows.

The Company’s revenue and operating results have varied historically from period to period and may continue to do so. The Company has identified below certain of the factors that may cause the Company’s revenue and operating results to vary:

| • | seasonal weather patterns in the construction industry on which the Company relies, with activity tending to be lowest in the winter and spring; |

| • | the timing of expenditure for maintaining existing equipment, new equipment and the disposal of used equipment; |

| • | changes in demand for the Company’s services or the prices it charges due to changes in economic conditions, competition or other factors; |

| • | changes in the interest rates applicable to the Company’s variable rate debt, and the overall level of the Company’s debt; |

| • | fluctuations in fuel costs; |

| • | general economic conditions in the markets where the Company operates; |

| • | the cyclical nature of the Company’s customers’ businesses; |

| • | price changes in response to competitive factors; |

| • | other cost fluctuations, such as costs for employee-related compensation and benefits; |

| • | labor shortages, work stoppages or other labor difficulties and labor issues in trades on which the Company’s business may be dependent in particular regions; |

| • | potential enactment of new legislation affecting the Company’s operations or labor relations; |

| • | timing of acquisitions and new branch openings and related costs; |

| • | possible unrecorded liabilities of acquired companies and difficulties associated with integrating acquired companies into the Company’s existing operations; |

| 24 |

| • | changes in the exchange rate between the United States dollar and Great Britain pound sterling; |

| • | potential increased demand from the Company’s customers to develop and provide new technological services in the Company’s business to meet changing customer preferences; |

| • | the Company’s ability to control costs and maintain quality; |

| • | the Company’s effectiveness in integrating new locations and acquisitions; and |

| • | possible write-offs or exceptional charges due to changes in applicable accounting standards, reorganizations or restructurings, obsolete or damaged equipment or the refinancing of the Company’s existing debt. |

The Company’s business is highly competitive and competition may increase, which could have a material adverse effect on the Company’s business.

The concrete pumping industry is highly competitive and fragmented. Many of the markets in which the Company operates are served by several competitors, ranging from larger regional companies to small, independent businesses with a limited fleet and geographic scope of operations. Some of the Company’s principal competitors may have more flexible capital structures or may have greater name recognition in one or more of the Company’s geographic markets than the Company does and may be better able to withstand adverse market conditions within the industry. The Company generally competes on the basis of, among other things, quality and breadth of service, expertise, reliability, price and the size, quality and availability of its fleet of pumping equipment, which is significantly affected by the level of the Company’s capital expenditures. If the Company is required to reduce or delay capital expenditures for any reason, including due to restrictions contained in, or debt service payments required by, its credit facilities or otherwise, the ability to replace the Company’s fleet or the age of the Company’s fleet may put it at a disadvantage to its competitors and adversely impact the Company’s ability to generate revenue. In addition, the Company’s industry may be subject to competitive price decreases in the future, particularly during cyclical downturns in the Company’s end markets, which can adversely affect revenue, profitability and cash flow. The Company may encounter increased competition from existing competitors or new market entrants in the future, which could have a material adverse effect on the Company’s business, financial condition, results of operations and cash flows.

The Company is dependent on its relationships with key suppliers to obtain equipment for the Company’s business.

The Company depends on a small group of key manufacturers of concrete pumping equipment, and has historically relied primarily on three companies, the largest two of which experienced ownership changes in 2012. The Company cannot predict the impact on its suppliers of changes in the economic environment and other developments in their respective businesses, and the Company cannot provide any assurance that its vendors will provide their historically high level of service support and quality. Any deterioration in such service support or quality could result in additional maintenance costs, operational issues, or both. Insolvency, financial difficulties, strategic changes or other factors may result in the Company’s suppliers not being able to fulfill the terms of their agreements with it, whether satisfactorily or at all. Further, such factors may render suppliers unwilling to extend contracts that provide favorable terms to the Company, or may force them to seek to renegotiate existing contracts with the Company. The Company believes the market for supplying equipment used in the Company’s business is increasingly competitive; however, termination of the Company’s relationship with any of the Company’s key suppliers, or interruption of the Company’s access to concrete pumping equipment, pipe or other supplies, could have a material adverse effect on the Company’s business, financial condition, results of operations and cash flows in the event that the Company is unable to obtain adequate and reliable equipment or supplies from other sources in a timely manner or at all.

If the Company’s average fleet age increases, the Company’s offerings may not be as attractive to potential customers and the Company’s operating costs may increase, impacting the Company’s results of operations.

As the Company’s equipment ages, the cost of maintaining such equipment, if not replaced within a certain period of time or amount of use, will likely increase. The Company estimates that its fleet assets generally will have a useful life of up to 25 years depending on the size of the machine, hours in service, yardage pumped, and, in certain instances, other circumstances unique to an asset. The Company manages its fleet of equipment according to the wear and tear that a specific type of equipment is expected to experience over its useful life. As of October 31, 2018, the average age of the Company’s equipment in the United States and the United Kingdom was approximately 10 years and 8 years, respectively, and it is the Company’s strategy to maintain average fleet age at approximately 10 years. If the average age of the Company’s equipment increases, whether as a result of the Company’s inability to access sufficient capital to maintain or replace equipment in a timely manner or otherwise, the Company’s investment in the maintenance, parts and repair for individual pieces of equipment may exceed the book value or replacement value of that equipment. The Company cannot assure you that costs of maintenance will not materially increase in the future. Any material increase in such costs could have a material adverse effect on the Company’s business, financial condition and results of operations. Additionally, as the Company’s equipment ages, it may become less attractive to potential customers, thus decreasing the Company’s ability to effectively compete for new business.

| 25 |

The costs of new equipment the Company uses in its fleet may increase, requiring it to spend more for replacement equipment or preventing it from procuring equipment on a timely basis.

The cost of new equipment for use in the Company’s concrete pumping fleet could increase due to increased material costs to the Company’s suppliers or other factors beyond the Company’s control. Such increases could materially adversely impact the Company’s financial condition, results of operations and cash flows in future periods. Furthermore, changes in technology or customer demand could cause certain of the Company’s existing equipment to become obsolete and require it to purchase new equipment at increased costs.

The Company sells used equipment on a regular basis. The Company’s fleet is subject to residual value risk upon disposition, and may not sell at the prices or in the quantities it expects.

The Company continuously evaluates its fleet of equipment as it seeks to optimize its vehicle size and capabilities for its end markets in multiple locations. The Company therefore seeks to sell used equipment on a regular basis. The market value of any given piece of equipment could be less than its depreciated value at the time it is sold. The market value of used equipment depends on several factors, including:

| • | the market price for comparable new equipment; |

| • | wear and tear on the equipment relative to its age and the effectiveness of preventive maintenance; |

| • | the time of year that it is sold; |

| • | the supply of similar used equipment on the market; |

| • | the existence and capacities of different sales outlets; |

| • | the age of the equipment, and the amount of usage of such equipment relative to its age, at the time it is sold; |

| • | worldwide and domestic demand for used equipment; |

| • | the effect of advances and changes in technology in new equipment models; |

| • | changing perception of residual value of used equipment by the Company’s suppliers; and |

| • | general economic conditions. |

The Company includes in income from operations the difference between the sales price and the depreciated value of an item of equipment sold. Changes in the Company’s assumptions regarding depreciation could change the Company’s depreciation expense, as well as the gain or loss realized upon disposal of equipment. Sales of the Company’s used concrete pumping equipment at prices that fall significantly below the Company’s expectations or in lesser quantities than the Company anticipates could have a negative impact on the Company’s financial condition, results of operations and cash flows.

The Company is exposed to liability claims on a continuing basis, which may exceed the level of the Company’s insurance or not be covered at all, and this could have a material adverse effect on the Company’s operating performance.